Understanding the Path Forward When You Inherit a Home

Can you sell an inherited house before probate? The short answer is usually no—not until legal authority is established. However, specific exceptions and pathways can make the process faster than you might think.

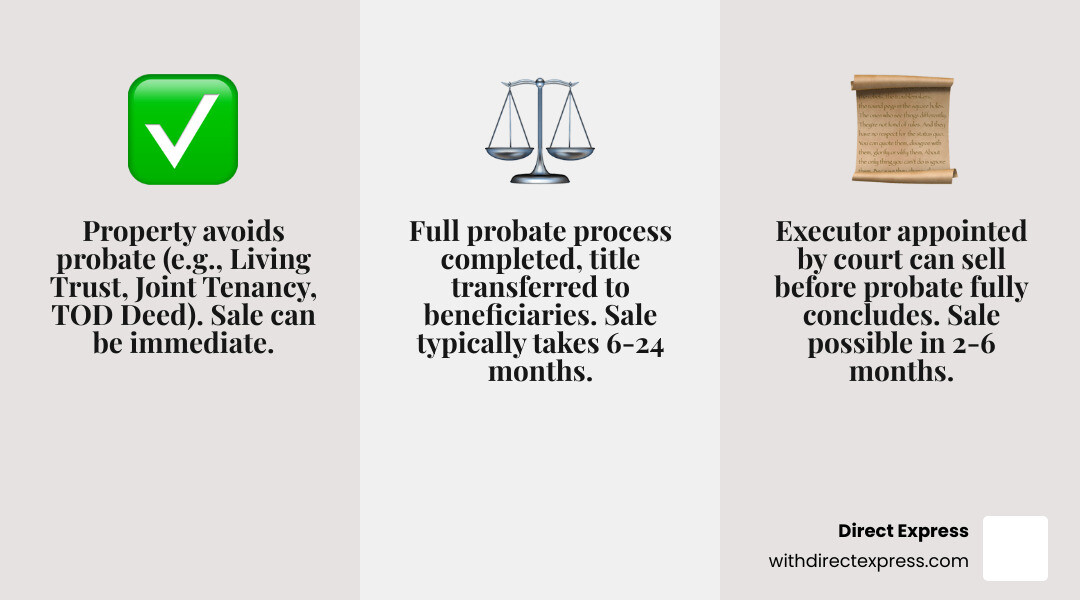

Quick Answer:

- Before probate begins: You can only sell if the property was set up to avoid probate entirely (through a living trust, joint tenancy, or transfer-on-death deed).

- During probate: The executor can sell the property once appointed by the court, even before probate is fully complete.

- Without probate: Some small estates may qualify for simplified procedures that allow faster sales.

- Timeline: Probate typically takes 6 to 24 months, but selling can often begin before the process concludes.

Inheriting a home brings a mix of grief, legal complexity, and financial decisions. The probate process can feel like a roadblock, but that’s not always the case. While you generally cannot sell an inherited house before establishing legal authority through probate, understanding the exceptions and the executor’s powers during probate can help you move forward much sooner than the full probate timeline suggests. Some properties bypass probate completely, while others can be marketed and sold while probate is still in progress.

As Joseph Cavaleri, with over two decades leading property transactions through Direct Express Realty, I’ve guided countless families through the question of can you sell an inherited house before probate and the practical steps to make it happen. My experience navigating probate sales, estate settlements, and inherited property transactions has shown me that knowledge and preparation make all the difference.

What is Probate and How Does It Affect a Home Sale?

When a person passes away, their estate—all their assets and debts—enters a legal process called probate. This process validates the will, settles liabilities, and distributes remaining assets to beneficiaries. For many Florida families, the home is the most significant asset, making its sale during probate a critical concern.

At its core, probate establishes legal authority. Without it, no one can legally sell, transfer, or manage the deceased’s assets, including real estate. The court appoints an executor, or personal representative, to oversee this process.

The probate timeline varies. While some estates close in six months, complex cases can take a year or two. This lengthy period can be frustrating for those wanting to sell an inherited property in Tampa Bay or St. Petersburg.

The Probate Process Explained

The probate journey follows several key steps:

- Filing the Will and Petition: The process begins by filing the will, death certificate, and a petition to open probate with the appropriate Florida court.

- Executor Appointment: The court formally appoints an executor, granting them legal authority to act for the estate.

- Notifying Creditors: The executor must notify all known creditors, who have a specific period to file claims.

- Asset Inventory and Appraisal: All assets are inventoried and appraised to determine the estate’s value for tax and distribution purposes.

- Paying Debts and Taxes: All legitimate debts, funeral expenses, and taxes are paid from estate assets before beneficiaries receive anything.

- Final Asset Distribution: Remaining assets are distributed to beneficiaries per the will or Florida’s intestate succession laws.

Navigating these steps can be complex. For a deeper understanding, explore our resources on Real Estate Law Florida.

What Happens if There Is No Will?

If a person dies without a valid will (intestate), the court appoints an administrator to manage the estate. Instead of following a will, Florida’s intestacy laws dictate how assets are distributed, with priority given to the surviving spouse, children, and other close relatives. The absence of a will often leads to a lengthier and more complex probate process, as the court must follow statutory guidelines. We advise clients in Tampa, Largo, and throughout Florida to consult an estate planning attorney to avoid such issues.

The Core Question: Can You Sell an Inherited House Before Probate?

In most cases, you cannot legally sell an inherited house before probate begins. The legal authority to sell rests with the deceased’s estate until an executor is appointed or an exception applies. Without a clear title transfer through probate, a buyer cannot take legal ownership.

However, the journey isn’t always a long wait. The executor, once appointed by the court early in the process, gains the right to manage and sell estate assets. Their actions must be in the best interest of the beneficiaries, and sometimes court approval is needed, but this authority is the key to selling before probate is finalized.

For specific guidance, visit our page: Selling Inherited Property Florida.

Selling Before Probate Begins: The Legal Exceptions

You can sell an inherited house before probate only in specific situations where probate isn’t required. As one source notes, you can only sell before probate “when probate isn’t required in the first place.” These exceptions include:

- Living Trust: If the property is in a living trust, the successor trustee can manage or sell it per the trust’s terms, bypassing probate.

- Joint Tenancy with Right of Survivorship: Common among spouses, the surviving owner automatically inherits the property and can sell it without probate.

- Transfer-on-Death (TOD) Deed: In states that allow it, a TOD deed transfers the property directly to a beneficiary upon death, avoiding probate.

- Small Estate Affidavits: Florida offers simplified procedures for small estates below a certain value. These processes, like Summary Administration, can significantly shorten the timeline for a sale.

When can you sell an inherited house before probate is finished? The Executor’s Authority

Even if probate is necessary, a sale can often happen before the process concludes. Once the court appoints the executor, they are legally empowered to act for the estate.

- Executor’s Legal Duty: The executor must act in the estate’s best interest, which may include selling a property to preserve its value and avoid ongoing costs.

- Will Instructions: If the will directs a sale or grants the executor broad powers, the process is more straightforward.

- Selling to Pay Debts (Abatement): An executor may need to sell the house during probate to pay estate debts. This is known as abatement.

- Beneficiary Agreement: If all beneficiaries agree, the executor can often proceed with a sale during probate, sometimes through a less court-supervised “Informal probate” process.

- Court Approval: The executor might still need court approval for the sale, but this often happens early enough to allow for marketing and selling before probate is final.

Our team at Direct Express provides Home Selling Assistance Largo and across Florida to guide you.

Can siblings force the sale of an inherited house before probate is resolved?

Disagreements among co-heirs are common. If beneficiaries cannot agree on selling, one or more siblings can potentially force a sale through a partition action—a lawsuit asking a judge to order the property sold and the proceeds divided.

This can occur during probate, but it is a costly and time-consuming process that may not yield the best market price. Before resorting to a lawsuit, siblings should explore buyout options, where one heir buys out the others’ shares. Mediation is another effective, less adversarial approach to reach a mutual agreement. “Selling with multiple heirs” requires a clear strategy to avoid conflict, and our team can connect you with professionals experienced in these situations.

A Practical Guide to Selling an Inherited Property

Once you have the legal authority to sell, the next step is preparing the house for the market. A strategic approach will maximize value and ensure a smooth transaction. Our Home Selling Checklist is a great starting point.

Step 1: Gather Essential Documents and Determine Value

Getting your paperwork in order is paramount to prevent delays. Key documents include:

- Grant of Probate (or Letters of Administration): The court document proving the executor’s authority to sell the property.

- Death Certificate: Required by the court, title company, and others.

- Original Will (if applicable): Outlines the deceased’s wishes.

- Property Title Deed: Proves the deceased’s ownership.

- Mortgage Statements: Details any outstanding loan balance.

- Date-of-Death Appraisal: Crucial for taxes, this appraisal establishes the property’s value at the time of death, creating a “stepped-up basis” that can minimize capital gains tax. Our team can provide a Real Estate Market Analysis to help.

Step 2: Prepare and Market the House

An inherited home may need work to appeal to buyers in Palm Harbor or Tampa. Focus on:

- Decluttering and Cleaning: Thoroughly clean and remove personal items to create a neutral, appealing space.

- Necessary Repairs: Address critical issues like leaks or broken appliances. A pre-listing inspection can help identify problems.

- Staging and Curb Appeal: Professional staging can help buyers envision themselves in the home, while simple landscaping and a clean exterior boost first impressions.

- Professional Photography: High-quality photos are essential for online listings.

- Working with a Probate-Savvy Realtor: An agent experienced in probate sales is invaluable. Our Tampa Bay Realtors are well-versed in handling inherited properties.

Step 3: Choose Your Selling Strategy

Your selling strategy depends on your priorities: speed, profit, or convenience.

- Traditional Market Sale: Listing with a realtor on the open market usually achieves the highest price but takes longer.

- Selling “As-Is”: This option offers speed and convenience if the property needs significant repairs, though typically at a lower price.

- Sell House Quickly with a Cash Offer: For maximum speed and a hassle-free sale, a cash offer is ideal. Our Cash Home Buyers St Petersburg team buys properties in any condition, often closing in weeks and eliminating the need for repairs, staging, or commissions.

Financial and Emotional Realities of the Sale

Selling an inherited home involves significant financial implications and often carries a heavy emotional weight. Understanding both aspects is key to a successful and less stressful process.

Navigating Taxes on an Inherited Home Sale

Beneficiaries often worry about taxes, but the rules for inherited property are often favorable.

- Stepped-Up Basis: Inherited property benefits from a “stepped-up basis,” where your cost basis becomes the property’s fair market value on the date of death. This significantly reduces or eliminates capital gains tax, as you only owe tax on appreciation after you inherit it. For example, if a home was worth $300,000 at death and you sell it for $310,000, your taxable gain is only $10,000.

- Inheritance and Estate Taxes: Florida has no state inheritance tax. Federal estate tax only applies to very large estates (over $12.92 million in 2023), so most beneficiaries will not owe it.

- Avoiding Capital Gains: To further minimize taxes, you can sell the home quickly before it appreciates further. Alternatively, if you live in the home for at least two of the five years before selling, you may qualify for the capital gains tax exclusion of up to $250,000 ($500,000 for joint filers).

Always consult a tax professional for advice custom to your situation.

Can You Rent Out the Inherited House?

Some beneficiaries consider renting the property to generate income. This can be a great option, especially if the home is mortgage-free. However, being a landlord requires active management, including maintenance, tenant screening, and following Florida’s landlord-tenant laws. Rental income is also taxable. If you’re considering this path, our Property Management services can help you steer the complexities. Our Beginners Guide to Property Management is also a valuable resource.

Coping with the Emotional Side of Selling

Selling a family home is rarely just a financial transaction; it’s often tied to grief and memories. It’s important to acknowledge these feelings.

- Acknowledge Emotions: It’s okay to feel sentimental attachment. Allow yourself time to process letting go.

- Communicate with Family: If there are multiple heirs, open communication is vital to prevent disagreements. As one expert noted, “Mixing family and money can be stressful… It’s essential that you work together… to make sure everyone is on the same page.”

- Balance Emotion with Practicality: While feelings are valid, balance them with objective financial decisions. Holding onto a property that is a financial burden may not be in anyone’s best interest.

- Seek Support: The process can be overwhelming. Lean on trusted friends, family, or professionals for guidance.

Conclusion

The question, “can you sell an inherited house before probate,” is a complex one, but as we’ve explored, the answer is often “it depends.” While selling before probate even begins is rare and typically reserved for properties set up to bypass the process entirely (like those in a living trust or joint tenancy), selling during probate once an executor is appointed is a much more common scenario.

The key takeaway is that legal authority is paramount. Once the court grants this authority to an executor, you can often begin the process of preparing, marketing, and even selling the inherited property, even if the entire probate case has not yet concluded. Understanding the probate process, knowing the legal exceptions, and being aware of the financial and emotional considerations involved will empower you to make informed decisions.

Navigating an inherited home sale requires expertise in real estate, law, and finance—and that’s where Direct Express comes in. We pride ourselves on offering integrated services under one roof, streamlining the entire property transaction process for our clients across St. Petersburg, Tampa Bay, Palm Harbor, Lutz, Wesley Chapel, Tampa, Largo, and Parrish, Florida. Whether you need assistance with property valuation, preparing the home for sale, understanding the legal nuances of probate, or exploring quick cash offers, our team is here to guide you.

If you’re facing the probate puzzle of an inherited property in Florida, don’t go it alone. Let us help you open up your inherited home’s sale. Learn more about how we can assist you with your specific needs at Sell Inherited Property Florida.