What You Need to Know About Selling Your Inherited Home

Inherited property for sale represents one of the most significant financial decisions you’ll face during an already emotional time. Understanding your options and tax obligations can turn a complex situation into a manageable process.

Quick Answer: Your Three Main Options

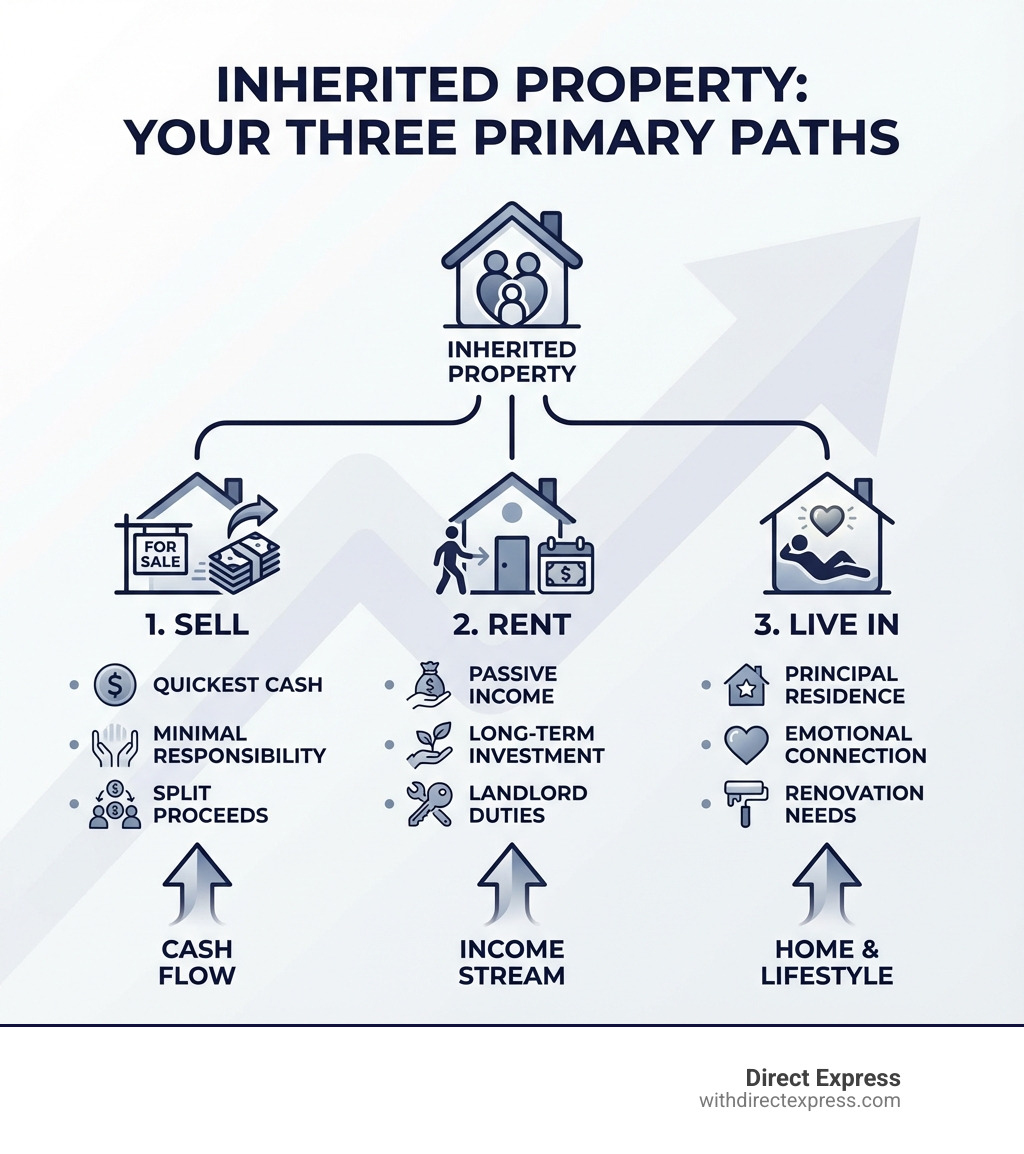

When you inherit a property, you have three primary choices:

- Sell the property – Convert it to cash and split proceeds among heirs

- Rent it out – Generate passive income as an investment property

- Move in – Make it your new principal residence

Key Tax Facts for Florida Inheritors:

- Florida has no state inheritance or estate tax.

- Federal estate tax only applies to very large estates, so most inheritors are not affected.

- The main tax to consider is capital gains tax when you sell the property.

- You benefit from a “stepped-up basis,” which resets the property’s cost basis to its market value at the time of death, often reducing or eliminating capital gains tax. You can read more about how stepped-up basis works in the U.S. tax system on the IRS page about basis of inherited property.

With a growing number of properties being passed down to the next generation, more families are facing these complex situations. Each inheritance brings its own mix of emotions—grief, gratitude, and sometimes stress—alongside important financial decisions that need clear thinking.

Whether the property was a childhood home filled with memories or an investment property you barely knew existed, you’re now facing practical questions about what to do next. Should you sell quickly? Consider renting? Move in yourself? And what about taxes?

I’m Joseph Cavaleri, Broker and CEO of Direct Express Realty, and over the past two decades I’ve guided countless families through the process of selling inherited property for sale in Florida, helping them steer both the emotional and financial complexities. My experience across real estate brokerage, property management, and mortgage lending gives me a comprehensive view of the entire process.

The First Step: Understanding the Estate’s Tax Obligations

When a loved one passes away, their estate, including any real estate, enters a legal process called probate here in Florida. This process ensures that debts are paid and assets are distributed according to the deceased’s will or Florida law. Understanding how the U.S. tax system, and specifically Florida law, handles inherited property is the first step.

In Florida, we don’t have a state inheritance tax, nor do we have a state estate tax. This means that inheriting a home in St. Petersburg, Tampa, or anywhere else in Florida won’t automatically trigger a state tax bill just for receiving the property. However, the federal government does impose an estate tax, but it only applies to very large estates (exceeding millions of dollars), which affects a small percentage of families. For most of us, federal estate tax won’t be a concern.

The primary tax consideration for an inherited property for sale in Florida revolves around capital gains when the property is eventually sold. The estate itself, through its executor (also known as a personal representative in Florida), has responsibilities for filing the deceased’s final income tax return (Form 1040) and, if the estate generates income during probate, an estate income tax return (Form 1041). Before assets can be fully distributed to heirs, the executor must ensure all taxes and debts of the estate are settled. Once the estate administration is complete, a Florida probate court provides an Order of Discharge, signifying that the executor has fulfilled their duties and the estate can be closed.

What is the “Stepped-Up Basis” Advantage?

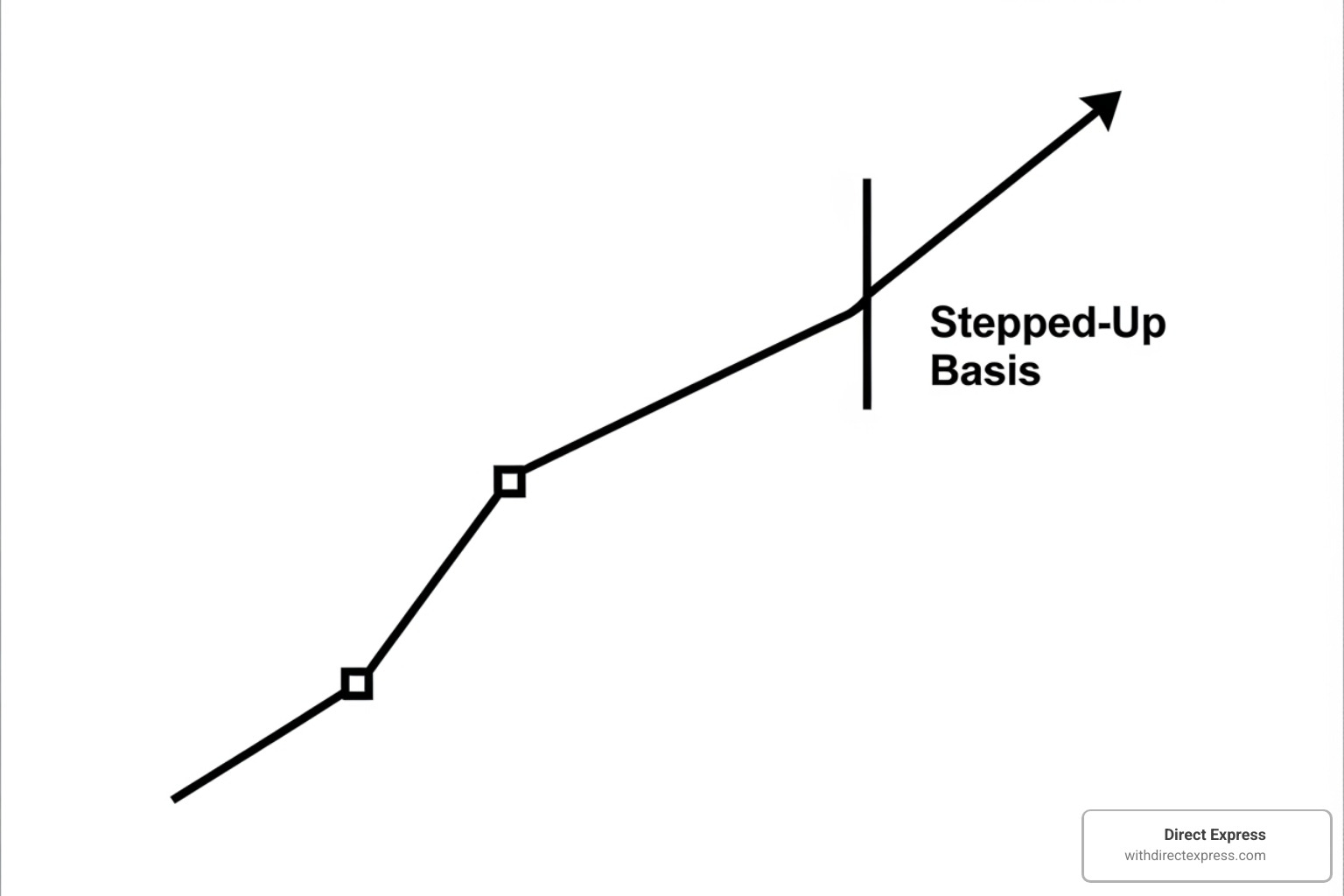

This is where the U.S. tax system offers a significant advantage to inheritors, often referred to as the “stepped-up basis.” Unlike receiving a property as a gift during someone’s lifetime (where you take on the donor’s original cost basis), when you inherit property, its cost basis is “stepped-up” to its fair market value (FMV) on the date of the previous owner’s death.

This stepped-up basis is your biggest tax advantage as an inheritor. Why? Because any appreciation in the property’s value before the deceased’s passing is effectively wiped clean for capital gains tax purposes. If you decide to sell the inherited property for sale soon after you inherit it, your capital gain will likely be minimal, or even zero, as the sale price will be close to your stepped-up basis.

For example, imagine a property in Palm Harbor that was purchased for $100,000 many years ago and is now worth $400,000 at the time of inheritance. If you were gifted this property while the owner was alive, your cost basis would be $100,000, and selling it for $400,000 would result in a $300,000 capital gain. However, with the stepped-up basis, your cost basis becomes $400,000. If you sell it a few months later for $405,000, your capital gain is only $5,000, not $300,000. This can save you a substantial amount in taxes, allowing you to maximize your inheritance.

The Executor’s Role in Preparing the Property

The executor (or personal representative) appointed by a Florida probate court plays a crucial role in managing the inherited property for sale before it can be distributed or sold. Their responsibilities include:

- Securing the Property: Ensuring the property is safe, insured, and maintained.

- Inventory and Appraisal: Listing all estate assets and having them professionally appraised to determine their fair market value at the date of death. This appraisal is critical for establishing the stepped-up basis.

- Paying Debts and Expenses: Using estate funds to pay off mortgages, property taxes, utilities, and any other outstanding debts of the deceased or the estate.

- Managing the Probate Process: Navigating the legal steps required by Florida statutes to administer the estate. This involves filing petitions, notifying creditors, and obtaining court orders.

- Filing Tax Returns: Preparing and filing the deceased’s final personal income tax return (Form 1040) and, if necessary, the estate’s income tax return (Form 1041).

- Distributing Assets: Once all debts and taxes are paid and the court approves, the executor distributes the remaining assets, including the property or its sale proceeds, to the beneficiaries according to the will or Florida’s intestacy laws.

The timeline for distribution in Florida probate can vary widely, from a few months for simple estates to over a year for more complex ones involving disputes or significant assets. During this time, the property cannot typically be sold or transferred without court approval.

Your Three Key Options for an Inherited Property

Inheriting a property, especially in desirable areas like Tampa Bay or St. Petersburg, presents us with a unique set of opportunities and challenges. Once the initial legal and tax problems are understood, it’s time to consider the property’s future. This decision often balances financial practicality, family dynamics, and emotional ties to the home.

We understand that an inherited home might hold countless memories, making a purely financial decision difficult. Our goal at Direct Express is to provide you with clear options and expert guidance to make the best choice for your unique situation.

Option 1: Sell the Property

For many, selling the inherited property for sale is the most straightforward path. It offers the quickest route to liquidity, allowing you to convert the asset into cash. This is especially appealing if there are multiple heirs who need to split the proceeds, or if maintaining the property is a burden. Selling minimizes long-term responsibility, freeing you from ongoing costs like property taxes, insurance, and maintenance.

At Direct Express, we specialize in helping families sell inherited property for sale efficiently across Florida. We can even facilitate a Sell House Quickly process, including cash offers, which can be invaluable when you need to liquidate an inherited asset without the traditional hassles of repairs, staging, and lengthy market times. Whether it’s a home in Largo or a vacation spot in Wesley Chapel, we can connect you with cash home buyers who understand the unique circumstances of inherited properties.

Option 2: Rent It Out for Income

If the property is in good condition and located in a desirable rental market like Tampa or Lutz, converting it into a rental property can be an excellent long-term investment strategy. This option allows you to generate passive income and benefit from the property’s potential for continued appreciation.

Becoming a landlord involves new responsibilities, from tenant screening and lease agreements to maintenance and repairs. However, with our comprehensive property management services at Direct Express, we can handle all these aspects for you. We’ve even created a Beginners Guide to Property Management to help you understand the ropes. Renting out an inherited property for sale transforms it into an income-generating asset, but rental income has its own tax implications, and you’ll need to keep meticulous records for deductions.

Option 3: Move In and Make It Your Home

For some, an inherited home might be the perfect opportunity to establish a new principal residence. This choice can be deeply emotional, offering a chance to preserve family legacy or simply move into a home you love. If you don’t currently own a home or are looking to downsize/upsize, moving into the inherited property can make financial sense.

Before moving in, consider any necessary renovations or repairs. Our construction services at Direct Express can help you transform the inherited space into your dream home. You might also need to explore mortgage options if there’s an existing loan or if you plan to finance renovations. Our mortgage experts are here to guide you. When considering this option, remember to consult our Buying a Home Checklist to ensure you’re prepared for all aspects of homeownership. Establishing the inherited property as your principal residence can also have significant tax benefits down the line, as we’ll discuss when we cover capital gains exclusions.

A Guide to Selling an Inherited Property for Sale

Deciding to sell an inherited property for sale is a big step, and ensuring a smooth, profitable transaction requires careful preparation. Whether it’s a quaint home in Parrish or a waterfront property in Palm Harbor, we’re here to help you steer the process.

First impressions matter. Preparing the property for sale means more than just cleaning up. It often involves decluttering, depersonalizing, and potentially making minor repairs to improve curb appeal and attract buyers. We can help you assess what improvements will yield the best return on investment. Timing the market can also play a role, and our local real estate experts can provide insights into current market conditions in your specific Florida location. Setting the right price is crucial – too high, and it lingers; too low, and you leave money on the table. Our comprehensive Home Selling Checklist is a great resource to guide you through these initial steps.

Assembling Your Professional Team

Selling an inherited property for sale is rarely a solo endeavor. You’ll benefit immensely from a team of professionals:

- REALTOR®: A knowledgeable REALTOR® from Direct Express is indispensable. We bring local market expertise, help you price the property correctly, market it effectively, negotiate offers, and guide you through the closing process. Our Tampa Bay Realtors are specialists in the local market and understand the nuances of inherited properties.

- Accountant/Tax Advisor: Given the tax implications, especially regarding capital gains, an accountant or tax advisor is vital. They can help you understand your stepped-up basis, calculate potential capital gains, and ensure you comply with all IRS regulations.

- Estate Attorney: Your estate attorney, who handled the probate process, will continue to be a key resource, ensuring the sale adheres to the terms of the will and Florida probate law, especially concerning clear title and distribution of proceeds.

- Property Appraiser: While your REALTOR® will provide a comparative market analysis, a formal property appraiser can offer an independent, professional valuation, which is often crucial for establishing the stepped-up basis at the time of death and for resolving disputes among heirs.

At Direct Express, our integrated services mean we can often provide many of these resources under one roof, streamlining the process and ensuring seamless communication between all parties involved.

Key Documents for an inherited property for sale

When it’s time to list your inherited property for sale in Florida, having the right documents ready will save you time and hassle. Here’s a list of what you’ll typically need:

- Death Certificate: Official proof of the previous owner’s passing.

- Will (if applicable): The last will and testament, outlining how the property should be distributed.

- Letters of Administration/Testamentary: These are court documents from the Florida probate court officially appointing the executor (personal representative) with the authority to act on behalf of the estate, including selling the property.

- Original Deed: The document proving ownership by the deceased.

- Property Tax Statements: Recent statements to show current tax obligations and history.

- Appraisal Report: The appraisal conducted at the time of death, establishing the fair market value for the stepped-up basis.

- Property Survey/Plat Map: If available, this shows the boundaries and features of the property.

- Title Insurance Policy: Provides protection against defects in the property’s title.

- Home Insurance Records: Current policy details and claims history.

Gathering these documents early will ensure a smoother transaction from listing to closing.

Considerations for an inherited property for sale

Selling an inherited property for sale comes with a few unique considerations:

- Selling “As-Is”: In Florida, it’s common to sell inherited properties “as-is.” This means the buyer accepts the property in its current condition, and the seller isn’t typically obligated to make repairs. However, Florida law still requires sellers to disclose all known material defects, even in an “as-is” sale. Transparency builds trust and protects you from future liability.

- Buyer’s Perspective: Buyers often view inherited properties as potential opportunities. They might expect a slightly lower price, especially if the property needs updates or is being sold “as-is.” However, a well-maintained property in a desirable area like Wesley Chapel or Tampa Bay can still command top dollar.

- Disclosing Known Defects: Always err on the side of caution. If you, as the seller, are aware of any issues (e.g., a leaky roof, foundation problems), disclose them in writing. Failing to disclose known defects can lead to legal complications down the road.

- Insurance Coverage: Ensure the property remains adequately insured throughout the sale process, especially if it’s vacant. Standard homeowner’s policies may not cover vacant properties, so you might need specialized vacant home insurance. This protects against damage, vandalism, or liability claims.

- Splitting Proceeds Fairly: If there are multiple heirs, clear communication and a formal agreement on how sale proceeds will be split are essential. Your estate attorney will oversee this distribution according to the will or court order, ensuring fairness and preventing disputes.

Strategic Tax Planning to Maximize Your Inheritance

Navigating the tax landscape for an inherited property for sale can feel like a maze, but with proactive planning and the right guidance, we can help you minimize your tax burden and maximize your inheritance. This is where our expertise in Real Estate Portfolio Growth truly shines, even for a single inherited asset.

The Capital Gains Exclusion for a Main Home

In the U.S., a powerful tax break called the Capital Gains Exclusion for the Sale of a Main Home allows homeowners to exclude a significant portion of capital gains when selling their primary residence.

Here’s how it generally works in the U.S.: If you own and live in a home as your main residence for at least two of the five years leading up to its sale, you can exclude up to $250,000 of capital gain (or $500,000 for married couples filing jointly).

How does this apply to an inherited property for sale?

If you inherit a home and decide to move into it, making it your principal residence for at least two years, you can then use this exclusion when you sell it. This means that any appreciation after you inherited it (and after your stepped-up basis) could be largely tax-free, up to the exclusion limits. However, you can only claim one main home. If you already have a principal residence, moving into the inherited home will require careful planning to optimize which property gets the exclusion.

Capital Gains Tax on Inherited Property

As we discussed, the stepped-up basis is your friend here. When you sell an inherited property for sale, your capital gain is calculated by subtracting your stepped-up basis (the fair market value at the date of death) from the final sale price, minus any selling expenses (like realtor commissions or closing costs).

For example, if you inherited a property in Tampa with a stepped-up basis of $400,000, and you sell it for $420,000 with $10,000 in selling expenses, your capital gain would be $10,000 ($420,000 – $400,000 – $10,000).

In the U.S., capital gains are generally categorized as short-term (for assets held one year or less) or long-term (for assets held longer than one year). Inherited property automatically receives long-term capital gain treatment, regardless of how long you actually held it, thanks to a special rule. Long-term capital gains are typically taxed at lower rates (0%, 15%, or 20% depending on your income bracket) than ordinary income.

You will report the sale of the inherited property for sale on your federal income tax return (Form 1040), typically on Schedule D and Form 8949.

Advanced Strategies: Spousal Transfers and Trusts

The U.S. tax code offers significant benefits for surviving spouses. When property passes to a surviving spouse, either directly or through a marital trust, it often qualifies for the unlimited marital deduction for federal estate tax purposes. This effectively defers any estate tax until the second spouse’s death. For income tax purposes, the surviving spouse also benefits from the stepped-up basis on inherited assets.

For more complex estates, or to provide for minor children or beneficiaries with special needs, establishing a trust can be a valuable estate planning tool. Trusts can hold inherited property, manage it according to specific instructions, and distribute assets over time. Careful trust planning with an estate attorney can achieve various goals, such as asset protection, probate avoidance, and specific distribution schemes.

It’s crucial to consult with an estate attorney and a tax advisor to explore these advanced strategies and determine the best approach for your specific situation in Florida.

Frequently Asked Questions about Selling Inherited Property

We often hear similar questions from clients navigating the sale of an inherited property for sale. Here are some of the most common ones, answered with a Florida perspective:

How is capital gains tax calculated on an inherited property?

In Florida, and across the U.S., capital gains tax on an inherited property for sale is calculated based on the “stepped-up basis.” This means your cost basis for the property is its fair market value (FMV) on the date of the deceased’s passing.

The calculation is:

(Sale Price) – (Stepped-Up Basis) – (Selling Expenses) = Capital Gain (or Loss)

For example, if the inherited property in St. Petersburg was appraised at $350,000 on the date of death (your stepped-up basis), and you sell it for $375,000, incurring $20,000 in realtor fees and other selling expenses, your capital gain would be:

$375,000 (Sale Price) – $350,000 (Stepped-Up Basis) – $20,000 (Selling Expenses) = $5,000 Capital Gain.

This $5,000 would be subject to long-term capital gains tax rates, which are typically lower than ordinary income tax rates.

How long do I have to sell an inherited house?

There is no legal time limit to sell an inherited property for sale in Florida or the U.S. You can hold onto it for as long as you wish. However, the longer you hold the property after the original owner’s death, the more likely it is to appreciate further. While appreciation is generally good, it means a larger capital gain when you eventually sell, potentially leading to a higher tax bill.

Also, consider the ongoing costs of ownership (property taxes, insurance, maintenance) during the holding period. For some, a quick sale is preferable to avoid these burdens and to distribute assets to heirs more promptly.

What happens if multiple heirs disagree on selling?

Disagreements among heirs are unfortunately common when dealing with an inherited property for sale. One heir might want to sell immediately, another might want to keep it, and a third might want to move in.

Open and honest communication is the first step. Try to understand each other’s perspectives and financial situations. If a consensus cannot be reached, mediation with a neutral third party (often an attorney) can help facilitate a compromise.

If all attempts at agreement fail, any heir can petition a Florida court for a “partition action.” This legal process forces the sale of the property and ensures the proceeds are divided among the heirs according to their ownership share. A partition action can be costly and time-consuming, so it’s generally considered a last resort. Our team at Direct Express can help mediate family discussions and provide objective market analysis to aid in these difficult decisions.

Conclusion

Navigating the sale of an inherited property for sale is a journey filled with both emotional significance and complex financial decisions. From understanding the nuances of Florida’s probate and tax laws to deciding whether to sell, rent, or move in, each step requires careful consideration.

We’ve covered the crucial role of the stepped-up basis in minimizing capital gains, the responsibilities of an executor, and the importance of assembling a professional team. Balancing the sentimental value of a family home with sound financial planning is key to a successful outcome.

At Direct Express, we understand these challenges intimately. With our integrated services encompassing real estate brokerage, property management, and mortgage lending, we offer a streamlined, comprehensive solution for families dealing with inherited property for sale in Tampa, St. Petersburg, and across Florida. We’re here to provide the expert guidance and support you need, every step of the way.

Don’t let the complexities overwhelm you. Take the next step with confidence. Get help selling your inherited property by reaching out to us today. We’re ready to help you turn your inherited asset into a clear path forward.