Why Sheriff Sale Houses Near Me Matter for Smart Buyers

Searching for sheriff sale houses near me can lead buyers to real estate at prices well below market value. These court-ordered auctions sell properties, often due to mortgage foreclosure or unpaid taxes, through a public bidding process. While the savings are significant, buyers face strict payment deadlines, limited property access, and the risk of hidden liens or repairs.

Quick Guide to Finding Sheriff Sale Houses:

- Check your county sheriff’s website – Most post upcoming sales in their civil division

- Search online auction platforms – Sites like Realauction and Bid4Assets list properties by location

- Review local legal newspapers – Required public notices appear 4 weeks before sale dates

- Prepare cash or financing – Expect 10-20% deposit immediately and full payment within 10-20 days

- Conduct title searches – You’re responsible for uncovering liens, taxes, and encumbrances

- Understand “as-is” conditions – No interior inspections, no warranties, and no guarantees

Unlike traditional sales, you can’t tour sheriff sale properties, financing must be pre-arranged, and sales can be cancelled last-minute. The minimum bid is often two-thirds of the appraised value, and buyers receive a Sheriff’s Deed, making them responsible for any evictions.

I’m Joseph Cavaleri, and as the Broker and CEO of Direct Express Realty since 2001, I’ve guided countless clients through the complexities of distressed property purchases, including navigating the unique challenges of sheriff sale houses near me throughout Florida. My integrated approach combines real estate expertise, property management insights, and practical construction knowledge to help buyers assess whether a sheriff sale represents a smart investment or a costly mistake.

What is a Sheriff’s Sale? Understanding the Basics

Searching for sheriff sale houses near me means exploring a unique type of real estate transaction. It’s a world away from a standard home purchase.

A sheriff’s sale is a public auction of properties ordered by a court to satisfy a judgment, usually from mortgage foreclosures or unpaid property taxes. It’s a forced sale to recover debts, not a voluntary one. Unlike a traditional transaction where you can tour homes, get inspections, and negotiate, a sheriff’s sale is a court-ordered event with strict legal procedures.

You’ll find a variety of properties at these auctions, including residential homes, commercial buildings, and vacant land. The common thread is that the previous owner defaulted on a financial obligation.

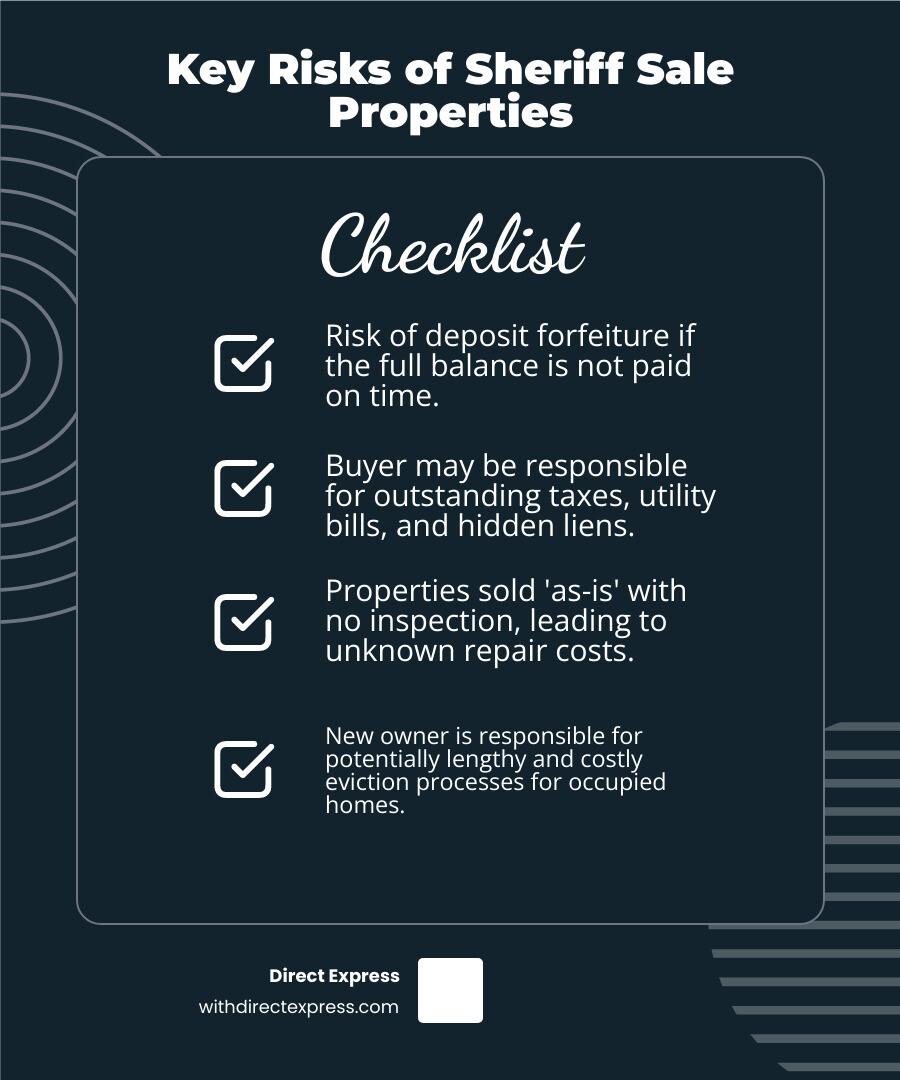

Here’s the most critical point: properties are sold in “as is” condition. The Latin phrase caveat emptor—”let the buyer beware”—is the rule. You purchase the property with all its flaws, visible or not. The sheriff and court offer no warranties or guarantees. Counties like Bucks County, PA, make this clear in their sale notices.

Another risk is sale cancellation. A sale can be stopped without notice, even at the last minute, if the owner settles the debt or a bankruptcy filing occurs. This uncertainty is part of the process when pursuing sheriff sale houses near me.

Understanding these fundamentals is essential before you bid. For those new to property acquisition, our Buying a Home guide offers helpful context, though sheriff sales are in a class of their own for complexity and risk.

How to Find Sheriff Sale Houses Near Me

Finding sheriff sale houses near me requires looking in specific channels that many buyers overlook. Once you know where to look, the process is straightforward.

Step 1: Start with Your Local County Sheriff’s Office

Your first stop should be your local county sheriff’s website. This is the official source for information. Look for the Civil Division or Real Estate Sales section to find upcoming auctions, property addresses, and deadlines. Procedures vary by county, so checking your local site is crucial. For example, counties like Bucks County, PA, and Chester County, PA, provide detailed listings and rules online. Bookmark your county’s page and check it regularly for new properties.

Step 2: Use Online Databases to Find Sheriff Sale Houses Near Me

Many counties now use online platforms for their auctions. Websites like Realauction and Bid4Assets specialize in distressed property sales, allowing you to search by state and county, set up alerts, and register for auctions. Auction.com is another large platform that lists sheriff’s sale properties among its foreclosure inventory. While these sites are convenient, always cross-reference information with the official county sheriff’s website for the latest updates on sales and cancellations.

Step 3: Don’t Overlook Traditional Media and Legal Publications

Newspapers still matter in the sheriff sale world because counties are legally required to publish public notices of upcoming sales. You’ll find these in the legal ad sections of local papers, often four weeks before the sale date. In Hunterdon County, NJ, for instance, ads run in the local paper on Thursdays. Specialized legal publications, like PA Legal Ads for Pennsylvania, also compile these notices. This can be a great way to find properties with less competition. Combining digital platforms with these traditional sources gives you the most complete picture of what’s available.

The Sheriff’s Sale Process: From Bidding to Ownership

Buying sheriff sale houses near me is a legally structured process that moves quickly from research to ownership. Understanding each stage is essential before you bid.

Before the Auction: Preparing to Bid

Successful buyers prepare relentlessly. Your first step is auction registration, as most jurisdictions require it before you can bid. Don’t wait until the last minute.

The deposit requirement is where it gets real. Upon winning, you must immediately produce a deposit, typically 10-20% of your bid. This is non-refundable if you fail to complete the purchase. Payment must be in a certified form like a cashier’s check or wire transfer; personal checks are not accepted.

Securing financing is a major hurdle. Traditional mortgages are usually not an option due to the short payment window (typically 10-20 days), while lenders need 30-45 days. This is why cash buyers or investors with pre-arranged hard money loans have an advantage. Our Property Investment Help resources can guide you on alternative funding strategies that fit these compressed timelines.

During the Auction: The Bidding Process

Auctions can be online through platforms like Bid4Assets or in-person at a courthouse. Understand the minimum bid rules. In Ohio, for instance, the first sale requires a bid of at least two-thirds of the appraised value. If it doesn’t sell, a second sale may have no minimum, offering potential for deeper discounts.

Bidding increments vary. Decide your absolute maximum bid before the auction starts and stick to it to avoid emotional overspending. Generally, any adult can bid, but check local rules for any specific restrictions.

After the Auction: Securing Your Property

Winning the bid starts a strict countdown. You must pay the balance within the deadline (often 10-20 business days) or forfeit your deposit. Once paid, you’ll receive a Sheriff’s Deed, which transfers ownership but does not guarantee a clear title.

Some states have a redemption period where the original owner can reclaim the property by paying all debts. Your ownership isn’t final until this period expires. Finally, taking possession is your responsibility. If the property is occupied, you must handle the eviction process, which may require filing a Writ of Possession and can take time and money. Our How to Buy Foreclosure guide walks through these post-purchase steps in greater depth.

The Risks and Rewards: What Every Buyer Must Know

Investing in sheriff sale houses near me is a high-stakes game. The chance to buy a property at a fraction of its market value is real, but so are the pitfalls that can turn a bargain into a burden.

Understanding the Financial Risks of Sheriff Sale Houses Near Me

The financial side can be brutal. Your deposit is on the line and will be forfeited if you can’t pay the full amount on time. You are also often responsible for outstanding taxes and utility bills. The sheriff’s sale doesn’t automatically clear these debts. A $50,000 “deal” could come with $30,000 in hidden costs from back taxes and unpaid bills.

Hidden liens from contractors, lawsuits, or even second mortgages can survive the sale and become your responsibility. And since you’re buying “as is” with no interior inspection, you must budget for unexpected repair costs. The property could have severe issues like foundation cracks, mold, or faulty wiring. These financial risks are why cash buyers with reserves, like those found through Cash Home Buyers St. Petersburg, often dominate this market.

The Critical Role of Due Diligence and Legal Counsel

Due diligence is your shield against financial disaster. A thorough title search before bidding is non-negotiable to uncover hidden debts. The Ohio Sheriff’s Office and others make it clear this is the buyer’s job.

Don’t try to interpret these reports yourself. Consult with a real estate attorney who specializes in foreclosures. They can explain the title report, local laws, and potential liabilities. As the sheriff’s office in Bucks County, PA, advises, they are there to conduct the sale, not protect your interests. Understanding local laws on redemption periods, evictions, and lien priorities is crucial, as they vary widely. Resources like Ohio Sheriff Sales Foreclosures and Judicial Auctions can provide state-specific details.

Turning a Sheriff Sale into a Smart Investment

Despite the risks, the rewards can be life-changing. The rental property potential is immense. Acquiring a property below market value creates instant equity, leading to higher cash flow. Our guides on topics like Apartment Buildings for Sale Near Me can help you scale your investment strategy.

The fix-and-flip strategy can also be lucrative. The low purchase price leaves room for renovations, turning a distressed property into a desirable home with a significant profit margin. For seasoned investors, sheriff sales offer a pipeline for rapidly building a real estate portfolio. The key is meticulous research, financial planning, and an expert team. At Direct Express, we guide clients through every step, from due diligence to property management.

Frequently Asked Questions about Sheriff Sales

We get a lot of questions about sheriff sales. The stakes are high, and the process is unfamiliar to many. Here are answers to the most common concerns for those searching for sheriff sale houses near me.

Can I get a mortgage for a sheriff sale house?

In most cases, no. The 10 to 20-day payment deadline is too short for a traditional 30 to 45-day mortgage process. Lenders are also hesitant to finance a property they can’t inspect. This is why cash is king. If you don’t have cash, you’ll need a pre-arranged hard money loan or other private financing. You must have your funds completely secured before you bid.

What happens to the previous owner’s mortgage and other liens?

This is complex and varies by state. A first mortgage foreclosure typically clears junior liens (like second mortgages) but not senior ones (like property taxes). Federal tax liens, some HOA fees, and unpaid utility bills can also survive the sale and become your responsibility. A thorough title search is the only way to know what debts you will inherit. Always consult a real estate attorney to interpret the search results and advise on which liens will remain your problem. The Sheriff’s Office does not provide this information.

Can I inspect the property before the auction?

Almost always, the answer is no. You cannot conduct an interior inspection before purchase. This is a primary risk of sheriff sales. Your “inspection” is limited to a drive-by assessment of the exterior, roof, and neighborhood. You can’t see the condition of the plumbing, electrical systems, or check for mold or structural damage. You are essentially buying a mystery box. Because of this, you must budget a substantial contingency fund to handle whatever surprises await you after you take ownership of sheriff sale houses near me.

Conclusion: Is a Sheriff Sale Right for You?

So, should you take the plunge into sheriff sale houses near me? There’s no single answer. Sheriff sales are intense, high-risk, high-reward transactions that demand a level of preparation and risk tolerance far beyond a traditional home purchase.

The potential for a great deal is real, but so are the risks of hidden liens, unknown repair costs, and complex evictions. Success requires thorough research, including a comprehensive title search, and professional guidance from a real estate attorney experienced in foreclosures.

This is where an integrated approach matters. At Direct Express, we’ve spent over two decades helping clients in Florida steer everything from traditional purchases to complex distressed property acquisitions. Our unique structure provides real estate, renovation, and property management services under one roof, which is invaluable when dealing with the tight timelines and challenges of sheriff sale houses near me.

Are sheriff sales right for you? If you’re an experienced investor with cash reserves, they can be an excellent acquisition strategy. If you’re a first-time buyer, we’d encourage you to proceed with extreme caution and professional support.

The bottom line: sheriff sales can build wealth, but they require preparation, capital, and the right team. We’re here to help you make an honest assessment and support you if it’s the right move. Ready to explore? Find available Foreclosure Houses for Sale and let’s discuss if these opportunities align with your goals.