What is a Foreclosure Home?

Foreclosure houses for sale offer buyers the chance to purchase properties at significantly below-market prices. These homes can be found from 30% to 60% below market value, making them attractive for both homebuyers and investors.

Quick Answer: Where to Find Foreclosure Houses for Sale

- Bank-owned (REO) properties – Sold directly by banks after failed auctions

- Pre-foreclosure listings – Properties still owned by homeowners facing foreclosure

- Auction properties – Sold at public foreclosure auctions

- Government listings – HUD homes and other government-owned properties

- MLS listings – Available through real estate agents with foreclosure expertise

A foreclosure happens when a homeowner fails to make mortgage payments and the lender takes back the property. Unlike regular home sales, foreclosures are often sold as-is, meaning the buyer accepts the home in its current condition.

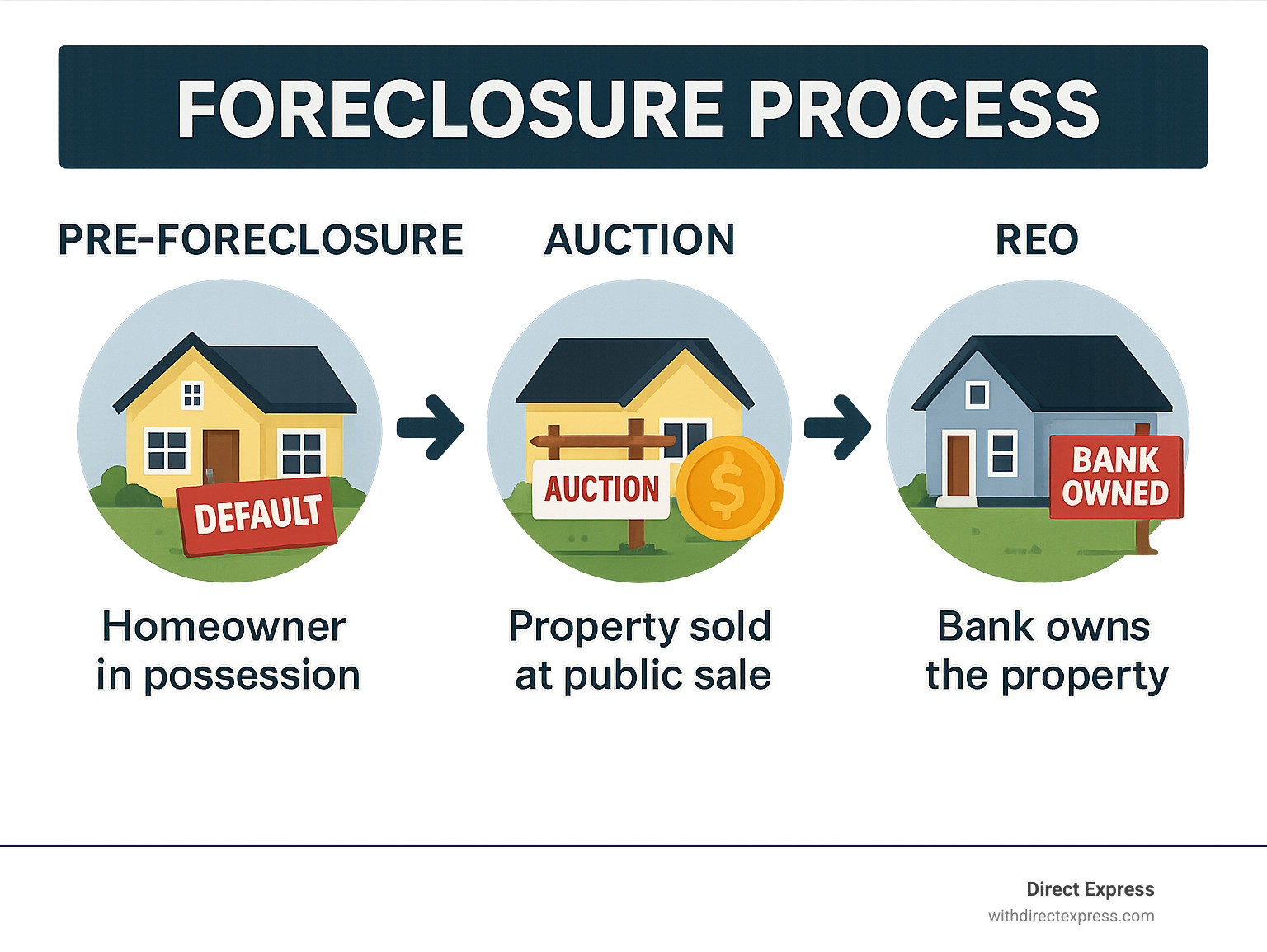

The foreclosure process creates three main buying opportunities: Pre-foreclosure (homeowner still owns but is facing foreclosure), Auction (sold at public sales, often for cash), and REO (Real Estate Owned) (bank-owned homes that didn’t sell at auction and are often the safest option).

While the savings are significant, buying a foreclosure requires careful planning. These properties often need substantial repairs or have title issues and other costs that can eliminate savings without professional guidance.

I’m Joseph Cavaleri, Broker and CEO of Direct Express Realty. With over two decades of experience, I specialize in complex real estate transactions like foreclosure houses for sale. My integrated approach—combining brokerage, property management, and construction—helps buyers successfully purchase and rehabilitate these properties while avoiding common pitfalls.

Important foreclosure houses for sale terms:

The Pros and Cons of Buying a Foreclosure

Stepping into foreclosure houses for sale can open doors to incredible possibilities, but know what you’re walking into. With two decades of experience, I can tell you that prepared buyers find these properties to be game-changers, but they can throw curveballs if you’re not ready.

Key Advantages of Foreclosure Properties

The financial benefits of foreclosure houses for sale are the main draw. With the right property, the numbers can be impressive.

Lower prices are the headline attraction. With savings of 30% to 60% below market value, you keep more money in your pocket. Banks want these properties off their books, which means motivated pricing.

This immediately creates instant equity. From the moment you close, you’re ahead of the game, building wealth before making a single improvement.

For investors, the high ROI potential is exciting. With our integrated construction services, we’ve helped clients transform distressed foreclosures into profitable investments. A lower purchase price means every dollar spent on improvements can multiply your returns.

You may also find less competition than in traditional sales, especially for homes needing work. While others fight over move-in ready properties, you can be the smart buyer who sees potential.

The key is having the right team to maximize these advantages. Our comprehensive approach at Direct Express shines here—we guide you through the purchase, financing, and any needed renovations. Learn more on our Buying a Home page.

What are the risks of buying foreclosure houses for sale?

Understanding the risks isn’t meant to scare you; it’s about preparing you for success.

The “as-is” condition is a major reality check. It means “what you see is what you get”—no repairs, warranties, or guarantees from the seller. This requires you to do your homework.

Hidden repair costs can turn a great deal into an expensive lesson. A charming exterior can hide outdated electrical, plumbing, or structural issues. That’s why we recommend thorough inspections with our construction team to spot problems early.

Title issues can be costly. Previous owners might have left behind liens or unpaid bills that become your responsibility. A comprehensive title search is essential.

Outstanding liens like property taxes, contractor bills, or HOA dues don’t disappear. You could inherit these debts with the property.

If the property is occupied, the eviction process is your responsibility. It can be a time-consuming, challenging, and expensive legal process.

Some states have redemption periods where former owners can reclaim their property by paying their debts. While rare with bank-owned homes, it’s important to understand local laws.

Professional property management is vital here. Vacant properties deteriorate quickly from vandalism, neglect, and code violations. Our property management services protect your investment from day one, handling maintenance and security.

The bottom line: foreclosure houses for sale are fantastic opportunities when approached with knowledge, preparation, and professional support.

The 5-Step Process to Your Foreclosure Purchase

Buying foreclosure houses for sale is manageable when broken into clear steps. After guiding countless clients in St. Petersburg, Tampa Bay, and surrounding areas, we’ve refined these five steps for the smoothest path to ownership.

Step 1: Secure Your Financing

Before browsing foreclosure houses for sale, secure your financing. Foreclosure financing has unique quirks that can make or break a deal.

Mortgage pre-approval is your first stop for REO properties. Some lenders are wary of properties in rough condition. Our mortgage team at Direct Express understands this market and works with lenders who do too.

For fixer-uppers, renovation loans like FHA 203k loans are game-changers, rolling the purchase price and repair costs into one mortgage. Our construction team can provide estimates to help you secure the right financing amount.

For auctions, cash is king. You’ll need proof of funds (like a cashier’s check) to register for bidding.

Don’t forget closing costs, which typically run 2% to 5% of the loan amount. Our team helps you budget for these so there are no surprises. Explore your options on our Mortgage options page.

Step 2: Find an Experienced Real Estate Professional

Buying foreclosure houses for sale requires an expert guide who knows this specialized market.

Agent expertise in foreclosures is essential. These deals have unique paperwork, timing, and pitfalls. Our agents are trained in foreclosure complexities, from “as-is” clauses to title red flags.

Foreclosure and REO specialists often have connections with bank REO departments and access to exclusive listings. They understand what motivates institutional sellers: speed and certainty.

Navigating listings is easier with MLS access. Our agents tap into databases updated every 15 minutes, ensuring you see opportunities as they arise.

When it comes to negotiation skills, banks are numbers-driven and want clean, quick closings. Our team knows how to craft offers that appeal to institutional decision-makers.

Our Mortgage Loan Officers work with our real estate team for a seamless experience.

Step 3: Conduct Thorough Due Diligence

Since foreclosure houses for sale are sold “as-is,” this due diligence phase is critical to saving money and avoiding a financial pitfall.

A professional home inspection is your financial lifeline. Foreclosed properties often have deferred maintenance or hidden damage.

Title searches are crucial because title issues can be expensive surprises. Our legal partners conduct comprehensive searches to uncover any outstanding judgments, back taxes, or other encumbrances.

Researching liens is also important. We advise clients to independently verify any existing liens, HOA dues, or municipal charges.

Key inspection points include: structural integrity (foundation, roof), major systems (HVAC, electrical, plumbing), water damage, mold, pests, and proper permits for past renovations. Also, check for environmental hazards (lead paint, asbestos, radon) and talk to neighbors about the property’s history.

Our Buying a Home Checklist walks you through every critical inspection point.

Step 4: Make a Competitive Offer

Found the right foreclosure house for sale? Now you need a strategic offer that wins without overpaying.

Your offer strategy depends on the foreclosure type. For REO properties, banks favor clean, quick deals with minimal contingencies. For auctions, set your maximum bid beforehand and stick to it.

Negotiating with banks is different from dealing with homeowners. Banks are focused on financial metrics and want a clean, quick closing. An experienced agent knows how to present your offer appealingly to these institutional sellers.

Understanding the offer process helps set expectations. Bank approvals can be slower than traditional sales. The legal paperwork for foreclosure sales includes specific documentation our team will help you complete correctly.

Our agents are seasoned negotiators. Learn more about our market expertise on our Realty Sell page.

Step 5: Close the Deal and Plan for Renovations

Congratulations! The final steps are completing the purchase and preparing for renovations.

The closing process resembles a traditional sale but with foreclosure-specific documents. Your title company and legal counsel will guide you through it.

Taking possession is the exciting moment the property becomes yours.

Your renovation budget should reflect your due diligence, including a contingency fund for surprises. Planning ahead prevents budget disasters.

Hiring contractors can make or break your renovation. Direct Express offers in-house construction and plumbing services, eliminating coordination headaches. Our integrated approach saves time and money while ensuring quality control.

For investors, consider professional property management. Direct Express handles everything from tenant screening to maintenance, protecting your investment. Find out how we can help with our Beginners Guide to Property Management.

Where to Find Foreclosure Houses for Sale

Finding foreclosure houses for sale doesn’t have to be a treasure hunt. With the right guidance, you can find great opportunities in St. Petersburg, Tampa Bay, Palm Harbor, Lutz, Wesley Chapel, Tampa, Largo, Parrish, Florida, and beyond. Here are the most effective strategies we use to help our clients.

Direct Bank and Lender Connections

Banks are often your best source for foreclosure houses for sale. They are motivated sellers who want to move properties quickly.

Most major banks have REO departments that manage their foreclosed properties. These bank-owned homes are often the safest foreclosure purchases, as the bank has usually handled evictions and title issues, wanting a clean transaction.

Direct bank listings are another avenue. Working with an agent who has established relationships with these institutions gives you an advantage, as we often learn about new listings before they hit the general market.

Through our network at Direct Express, we can access financial institution portals that aggregate REO listings, saving you time and giving you a full view of available properties.

Government-Related Listings

Government agencies also offer excellent opportunities for foreclosure houses for sale, often with unique buyer benefits.

Accessing government-related opportunities requires understanding the different programs. Properties foreclosed on FHA, VA, or USDA loans return to the market through government channels. These can include HUD homes, VA foreclosures, and other federal and state agency properties.

Understanding available programs is crucial. Government agencies often provide incentives like financing assistance, lower down payments, or priority for owner-occupants. A real estate professional can help you steer these opportunities and their requirements.

How can I find listings for foreclosure houses for sale?

The modern search for foreclosure houses for sale combines digital tools with traditional methods.

Specialized online portals are helpful starting points for categorizing properties by type, location, and price.

Real estate agent MLS access remains the gold standard. Our agents receive MLS updates every 15 minutes, giving you real-time access to new foreclosure houses for sale. This can be the difference between securing a great property and missing out.

Public auctions, hosted at county courthouses, offer another route but often require cash and prior research, as inspections usually aren’t allowed.

County records provide access to tax lien sales. These can offer properties at significant discounts, but navigating them requires local expertise.

Leveraging Direct Express’s network streamlines your search. With thousands of foreclosures available, a knowledgeable team saves you time. Our agents use MLS access, local market knowledge, and bank relationships to find the best properties matching your criteria and budget.

Frequently Asked Questions about Foreclosure Homes

When considering foreclosure houses for sale, many questions arise. Here are the answers to the most common concerns we hear from clients.

Can I get a regular mortgage for a foreclosure?

Yes, but it’s not always straightforward. Financing options depend on the property type and its condition.

For bank-owned (REO) properties, traditional mortgages are typically available. Pre-foreclosures can also qualify for standard financing.

However, property condition requirements are a major factor. If a foreclosure has significant safety hazards or structural damage, traditional lenders may deny the loan.

This is where renovation loan options are useful. Programs like FHA 203k or Fannie Mae HomeStyle Renovation loans let you roll the purchase and repair costs into one mortgage.

Lender criteria vary, so getting pre-approved specifically for a foreclosure is crucial. Our mortgage team specializes in these situations. Check out our Mortgage options page to see how we can help.

Auction properties are different, almost always requiring cash.

What does buying a house ‘as-is’ really mean?

When a foreclosure is marked “as-is,” it’s a serious commitment.

No seller repairs means exactly that. The bank or government seller will not fix anything, from a leaky faucet to a cracked foundation.

Once you close, buyer responsibility is total. Every repair and surprise issue becomes your problem to solve and pay for.

This is why the importance of inspections cannot be overstated. An inspection is your look into what you’re really buying. It helps you budget accurately, distinguishing between cosmetic updates and major overhauls like a new roof or plumbing system.

Potential for major defects is real with “as-is” properties. Our construction and plumbing experts can spot red flags and help you understand the true cost of ownership before you commit.

How long does it take to buy a foreclosure?

The timeline for buying a foreclosure house for sale can be unpredictable.

The timeline varies by type. Auction properties can be the fastest, with the sale often happening the same day, but the prep work takes weeks.

An REO sales timeline typically takes 30 to 90 days from offer to closing, often longer than traditional sales due to bank bureaucracy. Our integrated services at Direct Express streamline this by coordinating financing, inspections, and legal needs under one roof.

Pre-foreclosure purchases are wild cards, depending entirely on the homeowner’s situation.

Redemption period delays can add another wrinkle in some states, giving the former owner a legal right to reclaim the property. While rare with REO sales, this can delay your ability to take full possession.

The key is patience. Our team keeps you informed every step of the way.

Conclusion: Your Path to a Great Real Estate Deal

You’ve learned the essentials of buying foreclosure houses for sale. While it can seem overwhelming, our experience in St. Petersburg, Tampa Bay, and beyond shows that with the right preparation and guidance, these properties are game-changers.

You now understand how to find properties selling for 30% to 60% below market value and turn them into a dream home or a profitable investment. You know the different types of foreclosures and, most importantly, how to protect yourself from the risks.

The secret is preparation and having the right team. Securing financing first, partnering with experienced professionals, conducting thorough inspections, and budgeting for renovations sets you up for success.

This is where Direct Express shines. Instead of juggling multiple companies for buying, financing, inspections, and renovations, you get everything under one roof. Our real estate agents find the perfect foreclosure houses for sale, our mortgage team handles financing, and our construction and plumbing experts tackle any repairs.

We’ve seen buyers get frustrated coordinating different companies when issues arise. Our integrated approach means smoother communication, faster problem-solving, and a better experience for you.

Foreclosure properties offer opportunities that traditional sales can’t match. Yes, they require more homework, but the potential rewards are worthwhile.

Ready to start your journey? We’re here to guide you every step of the way.

Start your search for a foreclosure property today and let’s turn that foreclosure opportunity into your success story!