Your First Step to Homeownership

A Pre approval mortgage is your gateway to confident home buying – it’s a written commitment from a lender stating the maximum loan amount you qualify for based on verified financial information. This powerful document transforms you from a hopeful browser into a serious buyer with real purchasing power.

Quick Answer: What is a Pre-Approval Mortgage?

- Definition: A lender’s conditional commitment to loan you money up to a specific amount

- Requirements: Credit check, income verification, asset documentation, debt analysis

- Validity: Typically 60-120 days depending on the lender

- Benefits: Competitive advantage, budget clarity, faster closing process

- Credit Impact: Hard inquiry that may temporarily lower your score by a few points

Getting pre-approved isn’t just paperwork – it’s your competitive edge in today’s market. Research shows that some sellers won’t even allow home tours without pre-approval, and buyers with pre-approval letters are significantly more likely to have their offers accepted.

The process involves gathering financial documents, submitting an application, and undergoing a credit check. Most lenders can provide pre approval mortgage decisions within a few business days, with some offering instant online pre-approval.

I’m Joseph Cavaleri, and during my time as a Loan Officer at United Liberty Mortgage, I helped countless clients steer the pre approval mortgage process to secure their dream homes. Through Direct Express Realty, I continue to guide buyers through every step of homeownership, from initial financing to final closing.

Pre-Approval vs. Pre-Qualification: What’s the Difference?

When you start exploring homeownership, you’ll quickly encounter two similar-sounding terms that couldn’t be more different: pre-qualification and pre approval mortgage. Think of it like the difference between someone casually saying “I could probably help you move” versus showing up at your door with a truck, moving boxes, and a detailed plan!

Pre-qualification is your starting point – an informal assessment based on information you provide without verification. You’ll share basic details about your income, debts, and assets, often through a quick phone call or online form. The lender gives you a rough estimate of what you might qualify for, but it’s essentially an educated guess based on unverified information. No one’s checking your pay stubs or pulling your credit report yet.

This preliminary step is helpful for getting a ballpark figure and understanding whether your dream home is within reach. However, it carries little weight with sellers because there’s no real commitment behind it.

A pre approval mortgage, on the other hand, represents a serious lender commitment. This involves submitting a formal application with detailed financial documentation. The lender conducts a thorough review of your verified financials – they’ll want to see your W-2s, tax returns, bank statements, and employment history. They’ll also perform a hard credit check to assess your creditworthiness.

The result? A conditional commitment letter stating exactly how much the lender will loan you, often including specific terms like interest rate and loan duration. This document transforms you from a window shopper into a qualified buyer with real purchasing power.

| Feature | Pre-Qualification | Pre Approval Mortgage |

|---|---|---|

| Verification | Self-reported information | Documented proof required |

| Credit Impact | Soft pull or none | Hard credit inquiry |

| Seller Confidence | Low credibility | Strong buying signal |

| Timeline | Minutes to hours | Few days to weeks |

| Commitment Level | Estimate only | Conditional loan commitment |

| Documentation | Basic financial overview | Complete financial review |

In today’s competitive real estate market, especially in areas like Tampa Bay and St. Petersburg, sellers often won’t even consider offers without pre-approval letters. It shows you’re serious about buying a home and have the financial backing to follow through.

The difference between these two options can make or break your home buying experience. While pre-qualification might satisfy your curiosity about affordability, pre approval mortgage gives you the confidence and credibility to make competitive offers in any market.

The Step-by-Step Guide to Your Pre Approval Mortgage

Getting your pre approval mortgage is like preparing for a job interview – the better prepared you are, the smoother everything goes. I’ve walked hundreds of families through this process here in Florida, and I can tell you that having a clear roadmap makes all the difference.

The first decision you’ll face is choosing where to apply. Traditional banks and credit unions offer familiar, face-to-face service and often have competitive rates for existing customers. Mortgage brokers act like personal shoppers for loans, comparing options from multiple lenders to find your best deal – especially helpful if your financial situation has some unique twists.

Online applications have revolutionized the process, letting you apply from your couch at midnight if that’s when inspiration strikes. Many offer instant preliminary decisions, which can be incredibly satisfying when you’re eager to get started. However, don’t overlook the value of in-person meetings with mortgage specialists, particularly if you have questions about complex financial situations or want that personal touch during such a significant decision.

Now, let’s address the elephant in the room: credit score impact. Yes, getting a pre approval mortgage involves a hard credit check, which might temporarily lower your score by a few points. But here’s the good news – credit scoring models are designed to encourage mortgage shopping. Multiple mortgage inquiries within a 14-45 day window count as just one inquiry for scoring purposes. This means you can shop around for the best rates without repeatedly damaging your credit. Smart timing is key here. For detailed information about this process, check out What happens when a mortgage lender checks my credit?.

Documents and Information You’ll Need

Think of document gathering as creating your financial autobiography. Lenders want to see the complete story of your money – where it comes from, where it goes, and how responsibly you manage it. Getting organized beforehand saves time and stress later. Our First Home Buyer Checklist can help you stay on track.

Proof of income forms the foundation of your application. Your most recent 30 days of pay stubs show current earnings, while W2s and tax returns from the past two years demonstrate income stability. If you’re self-employed, you’ll need additional documentation like 1099s or profit and loss statements. An employment verification letter from your employer confirming your position, salary, and job tenure rounds out this picture.

Bank statements from the past 60 days for all accounts prove you have funds for your down payment and closing costs. This includes checking, savings, investment accounts, and retirement funds. Lenders also want to see asset information for any significant holdings like other real estate or valuable collections.

Your debt obligations need complete transparency. Credit card statements, car loans, student loans, and any support payments paint a clear picture of your monthly commitments. Don’t forget your employment history – lenders typically want two years of steady work, though job changes within the same field usually aren’t problematic.

Finally, have your government-issued photo ID ready, along with any documentation proving legal residency if applicable.

The Application and Credit Check Process

Once your paperwork is organized, the formal assessment begins. The lender conducts a hard credit inquiry that reveals your complete credit history – payment patterns, outstanding debts, and any past financial difficulties. While this might cause a small, temporary dip in your credit score, multiple mortgage inquiries within a short timeframe are treated as one for scoring purposes.

Before applying, I always recommend checking your credit report for free at AnnualCreditReport.com. Correcting errors beforehand can significantly improve your approval odds and terms.

Your debt-to-income ratio (DTI) becomes crucial here. If your total monthly debt payments (including your estimated mortgage) equal $3,000 and your gross monthly income is $9,000, your DTI is 33%. Most lenders prefer DTI ratios under 50%, with 36% or less opening doors to the best terms.

Lenders also conduct their own mortgage stress test to ensure you can handle payments even if circumstances change. This might involve calculating affordability at higher interest rates or different economic conditions, depending on your down payment amount and local regulations.

Key Questions to Ask Your Lender

Getting pre-approved isn’t a one-way street – you’re interviewing potential lenders just as much as they’re evaluating you. The right questions can reveal important details about your pre approval mortgage terms and help you choose the best partner.

Rate lock periods are critical in volatile markets. How long will your approved rate be guaranteed – 60, 90, or 120 days? Can you benefit from rate decreases during this period? Some lenders offer automatic adjustments if rates fall, which can save you thousands.

Ask about pre-approval extensions in case your house hunt takes longer than expected. Can you renew without starting over completely? Understanding prepayment penalties matters if you plan to pay extra toward principal or sell sooner than anticipated.

Closing cost estimates help you budget beyond the down payment. These fees vary significantly between lenders and can impact your total investment. Finally, explore the mortgage types available – fixed-rate, adjustable-rate, FHA, VA, or other specialized programs might better suit your situation.

For more comprehensive information about mortgage options and how they work, visit our Mortgage section.

At Direct Express, we understand that securing your pre approval mortgage is just the beginning of your homeownership journey. Our integrated approach means we can guide you from initial financing through finding the perfect property, and even help with property management if you decide to build an investment portfolio down the road.

What Happens After You Get Pre-Approved?

Congratulations! You’ve successfully secured your pre approval mortgage. This moment marks a real turning point in your home-buying journey – you’ve moved from dreaming about homeownership to having the financial backing to make it happen. I’ve watched countless clients experience this same surge of confidence when they first hold their pre-approval letter.

Think of your pre approval mortgage as your golden ticket to the housing market. You’re no longer just browsing open houses on Sunday afternoons; you’re a serious buyer with verified purchasing power. This change brings immediate advantages that can make or break your home search in today’s competitive market.

House hunting with confidence becomes your new reality. No more wondering if that beautiful home in Wesley Chapel is within reach – you know exactly what you can afford. This clarity saves you precious time and protects your heart from falling in love with properties beyond your budget. There’s nothing quite like the focused energy that comes from shopping with a clear financial boundary.

Your competitive advantage in the market is substantial. When multiple offers land on a seller’s desk, yours will stand out because it comes with proof of financing. Sellers and their agents know that pre-approved buyers are far more likely to successfully close the deal. In hot markets like Tampa Bay, some sellers won’t even schedule showings without seeing a pre-approval letter first.

Seller perception shifts dramatically in your favor once you have this document. You’re no longer seen as a hopeful buyer who might disappoint – you’re viewed as a qualified purchaser who can deliver on their offer. This credibility often translates into sellers being more willing to negotiate and work with you through the process.

At Direct Express Realty, we understand how crucial this phase is. Our team can guide you from your first property tour to signing the final papers, ensuring every step flows smoothly. Learn more about how we help sellers too on our Realty Sell page.

Understanding Your Pre approval mortgage Letter

Your pre approval mortgage letter isn’t just paperwork – it’s a detailed roadmap for your home purchase. Understanding each component helps you steer the buying process with confidence and avoid surprises along the way.

The maximum loan amount represents the highest sum your lender will provide based on their thorough review of your finances. This is the ceiling, not necessarily what you should spend. Many wise buyers choose homes well below their maximum approval to ensure comfortable monthly payments.

Your interest rate gives you a realistic picture of your borrowing costs. Most lenders lock this rate for a specific period, protecting you from market fluctuations while you house hunt. This rate lock is particularly valuable in changing market conditions.

The term length – typically 15 or 30 years – affects both your monthly payments and total interest paid over the life of your loan. Your lender will help you understand how different terms impact your overall financial picture.

Pay close attention to the expiration date on your letter. Most pre approval mortgage letters remain valid for 60 to 120 days, depending on your lender’s policies. This timeline creates a natural urgency for your home search without being overly restrictive.

Understanding the conditional approval aspect is crucial. Your pre-approval represents a strong commitment from your lender, but final approval depends on factors like the property appraisal and your continued financial stability. Think of it as a firm handshake agreement that becomes a signed contract once all conditions are met.

From Pre-Approval to Final Approval

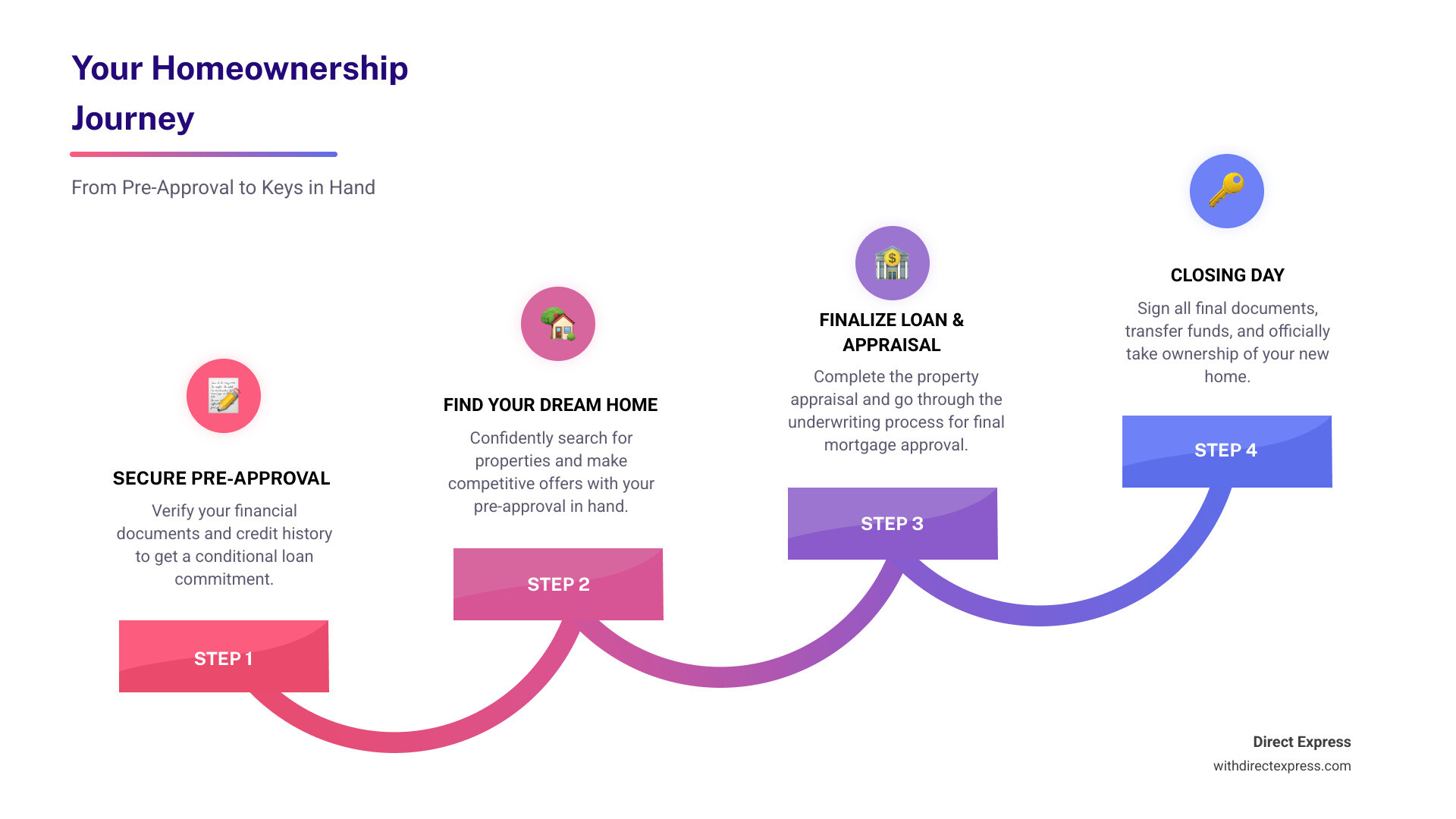

With your pre approval mortgage secured, the exciting phase of actually finding your home begins. This journey from pre-approval to keys in hand follows a predictable path that we’ve guided hundreds of clients through successfully.

Finding your perfect home becomes the focus of your energy. Your pre-approval gives you the confidence to tour properties knowing you can afford them. Whether you’re drawn to the historic neighborhoods of St. Petersburg or the family-friendly communities of Lutz, you can explore with purpose rather than uncertainty.

When you find “the one,” making an offer becomes your next step. Your real estate agent will craft a competitive proposal, and your pre-approval letter will accompany it as proof of your financial readiness. This documentation often gives your offer an edge over competing bids from unqualified buyers.

Once your offer is accepted and you’ve signed the purchase agreement, you’ll return to your lender for the final mortgage application. This step transforms your conditional approval into a formal loan application tied to your specific property choice.

The property appraisal protects both you and your lender by ensuring the home’s value supports your loan amount. An independent appraiser evaluates the property, comparing it to recent sales of similar homes in the area. This step prevents you from overpaying and gives your lender confidence in their investment.

During the underwriting process, your lender’s team conducts their final, comprehensive review. They’ll verify your employment one last time, confirm your assets haven’t changed dramatically, and ensure the property meets all lending guidelines. This thorough examination might feel intense, but it’s designed to protect everyone involved.

Final approval represents the finish line of your financing journey. When the underwriter gives their blessing, you’re cleared to close and officially become a homeowner. The keys to your new home in Palm Harbor or Parrish are just days away!

What to Do if Your Pre approval mortgage is Denied

Receiving a denial on your pre approval mortgage application can feel devastating, but it’s not the end of your homeownership story. I’ve seen many clients overcome initial setbacks to successfully purchase homes by addressing the underlying issues and trying again.

Understanding the reasons behind your denial is the first step toward improvement. Lenders must provide specific explanations for their decisions. Low credit scores often top the list, especially if your score falls below the lender’s minimum requirements for their loan programs.

High debt-to-income ratios frequently cause denials. If your existing monthly debt payments, combined with your potential mortgage payment, exceed the lender’s comfort zone, they’ll decline your application. Insufficient income presents a similar challenge – lenders need confidence that you can comfortably manage your mortgage payments alongside other living expenses.

Inconsistent employment history raises red flags for lenders who prefer borrowers with stable, predictable income sources. Credit report errors sometimes create problems that aren’t really yours, making it essential to review your credit report carefully before applying.

Improving your financial profile often opens doors that were previously closed. Boosting your credit score through consistent on-time payments and reduced credit card balances can make a dramatic difference in just a few months. Lowering your debt-to-income ratio by paying down existing debts, especially high-interest credit cards, improves your qualification odds significantly.

Exploring different lenders can yield surprising results. Each lender has unique guidelines and risk tolerances. What one institution denies, another might approve enthusiastically. Mortgage brokers excel at matching borrowers with suitable lenders, potentially saving you time and frustration.

Every challenge in the pre approval mortgage process teaches you something valuable about your financial position. At Direct Express, we’re committed to helping you overcome obstacles and achieve your homeownership goals, whether that takes three months or three years of preparation.

Frequently Asked Questions about Mortgage Pre-Approval

Getting a pre approval mortgage can feel overwhelming at first, especially when you’re juggling work, family, and the excitement of potentially buying your first home. Over the years, I’ve sat across from countless clients who had the same burning questions you probably have right now. Let me share the answers that have helped families from Wesley Chapel to Palm Harbor move forward with confidence.

How long does the mortgage pre-approval process take?

Here’s the honest truth – it really depends on how organized you are and which route you choose. I’ve seen clients get approved in a single day, while others took several weeks to gather everything together.

Online applications are your fastest friend here. Many lenders can give you an answer within hours or by the next business day. It’s pretty amazing how technology has streamlined this process. You can literally apply from your couch while watching Netflix!

Traditional applications where you meet in person or work over the phone typically take about three to seven days. This gives you more face time with your lender, which can be invaluable if you have questions or want that personal touch.

Now, if you’re self-employed or have multiple income streams, be patient with yourself. The process might stretch to a few weeks because lenders need to dig deeper into your financial picture. Think of it as them being thorough, not picky.

The real secret sauce? Having all your documents ready before you start. When clients come to me with their W2s, bank statements, and pay stubs already organized, the whole process moves like clockwork.

How long is a mortgage pre-approval valid for?

Your pre approval mortgage isn’t a lifetime guarantee – it’s more like a fresh carton of milk with an expiration date. Most lenders give you between 60 to 120 days to use it, with 90 days being pretty standard.

Think of it this way: your financial situation can change, and so can market conditions. That’s why lenders put these time limits in place. Some lenders, like TD, actually give you a generous 120-day window, which can be a real blessing in competitive markets.

Here’s what happens if time runs out: You’ll need to refresh your pre-approval. This usually means updating your financial information and possibly going through another credit check. It’s not starting from scratch, but it does require some legwork.

My advice? Start house hunting as soon as you get that pre-approval letter. The clock is ticking, and you want to make the most of your approved status.

Can pre-approval be used to buy an investment property?

Absolutely! A pre approval mortgage can definitely help you purchase investment properties, whether you’re eyeing a rental duplex in Tampa or a single-family home in St. Petersburg. However, the game changes a bit when you’re not buying your primary residence.

Investment properties come with stricter rules. Lenders typically want larger down payments – often 20% or more – and they’ll scrutinize your credit score more carefully. Your debt-to-income ratio needs to be even stronger because they know investment properties carry more risk.

But here’s the exciting part: lenders will consider rental income when calculating what you can afford. They usually count about 75% of projected rental income, accounting for those inevitable vacancy periods and maintenance costs. This can actually boost your buying power significantly.

If you’re serious about building a real estate portfolio, getting pre-approved for investment properties is crucial. It shows sellers you’re not just dreaming – you’re ready to close. Plus, it helps you understand exactly how much house you can afford as an investment.

At Direct Express, we love working with investors because we understand both sides of the equation. We can help you find the right property and then manage it once you own it. Check out our Invest in Real Estate section to learn more about building your investment portfolio with confidence.

Conclusion: Take the Next Step with Confidence

Getting your pre approval mortgage isn’t just checking off another item on your home-buying to-do list – it’s like getting your golden ticket to the real estate chocolate factory. You’ve transformed from someone who dreams about homeownership into someone who can actually make it happen.

Think about where you started this journey. Maybe you were scrolling through home listings online, wondering if you could ever afford that charming bungalow in Wesley Chapel or that promising duplex in Largo. Now you have real purchasing power, backed by a lender’s commitment and your own solid financial foundation.

The benefits of pre-approval extend far beyond just knowing your budget. You’ve gained a competitive edge that makes sellers take notice. You can tour homes with confidence, knowing you’re not wasting anyone’s time – especially your own. When you find “the one,” you can move quickly with an offer that carries real weight.

But here’s what makes this journey even better: you don’t have to handle it alone. At Direct Express, we understand that buying a home – whether it’s your first family residence or a strategic investment property – involves many moving pieces. That’s why we’ve built our services to work together seamlessly.

Your mortgage pre-approval is just the beginning. Once you’re ready to buy, our real estate team helps you find the perfect property. If you’re building an investment portfolio, our property management services ensure your rental properties generate steady income without the headaches. Need renovations or repairs? Our construction and plumbing teams have you covered.

This integrated approach means you’re not juggling multiple companies, multiple relationships, or multiple sets of paperwork. Everything flows smoothly from one step to the next, making your real estate experience as stress-free as possible.

The path to homeownership or real estate investment success is clearer now. You understand the difference between pre-qualification and pre-approval. You know what documents to gather and what questions to ask. You’re prepared for what happens after approval – and even what to do if you face a temporary setback.

So don’t let this momentum fade. Your pre approval mortgage is your ticket to the next chapter, whether that’s finally having your own keys to jingle or building wealth through real estate investment. The market waits for no one, and with your pre-approval in hand, you’re ready to seize the opportunities that come your way.

Explore property management for your next investment and see how Direct Express can support your entire real estate journey from start to finish.