Why Understanding Florida Real Estate Law is Essential for Property Success

Florida’s real estate law is a complex web of statutes governing all property transactions. Whether you’re buying, selling, or investing, understanding these rules is key to protecting your interests and saving money.

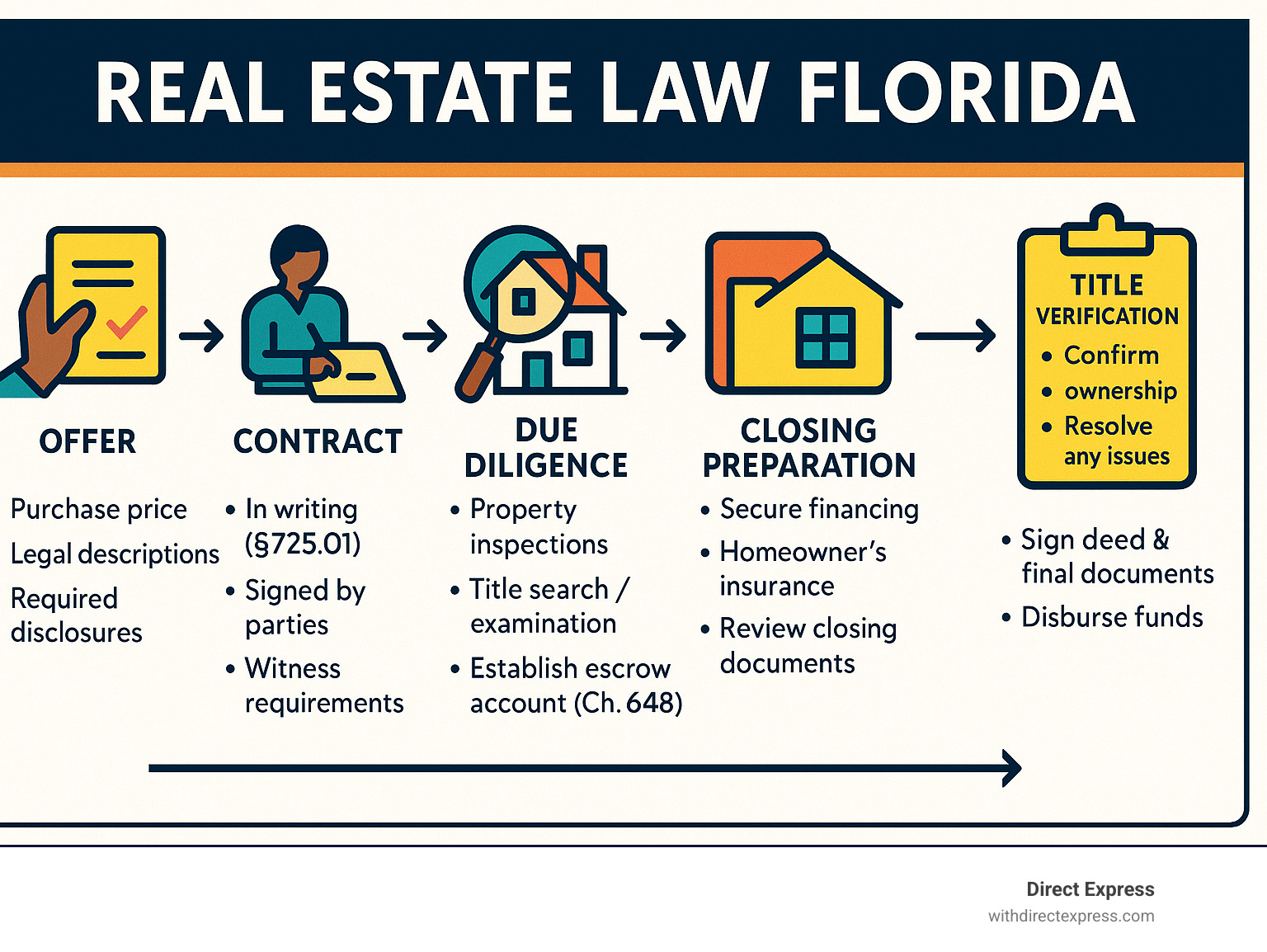

Key Areas of Florida Real Estate Law:

- Primary Statutes: Chapter 475 (Real Estate Brokers), Florida RESPA, Title XL Property Laws

- Property Rights: Homestead protections, adverse possession, ownership types

- 2024 Updates: New witness requirements, commission structure changes, fraud prevention measures

- Professional Licensing: 63-hour education requirement, brokerage relationships, conduct rules

- Transaction Protection: Title research, escrow requirements, foreclosure procedures

Florida’s market has unique laws, from specific disclosure requirements to new fraud prevention measures effective in 2024. Transaction brokers are common, providing limited representation to both parties.

Recent changes, like new witness address requirements and evolving commission structures, make legal knowledge more critical than ever. These updates create opportunities but also require careful navigation.

I’m Joseph Cavaleri, Broker and CEO of Direct Express Realty. With over two decades of experience in thousands of transactions, my background as a broker and former loan officer provides unique insight into how real estate law Florida affects your property deals.

Foundations of Florida Real Estate Law: Key Statutes and Property Rights

Think of real estate law Florida as the foundation of your property investment. Whether you’re buying in St. Petersburg or investing in Parrish, understanding these legal foundations will protect your assets.

Florida’s legal framework is primarily outlined in Title XL – “Real and Personal Property” of the Florida Statutes. This blueprint covers everything from land conveyances and mortgages to condominiums and homeowners’ associations.

Understanding Florida’s Core Real Estate Statutes

The heart of real estate law Florida is Chapter 475, which governs real estate brokers, sales associates, and schools. It’s the rulebook that ensures fair play and consumer protection. Alongside it, the Florida Real Estate Settlement Procedures Act (RESPA) protects consumers by demanding transparency in closing costs and prohibiting kickbacks or hidden fees. For a complete reference, you can review The 2024 Florida Statutes.

Your Rights as a Property Owner in Florida

Owning property in Florida comes with a powerful bundle of rights: the right to use, develop, have privacy, and exclude others. The way you hold title also has significant implications:

- Joint Tenancy: Two or more people own equal shares with a right of survivorship, meaning a deceased owner’s share automatically transfers to the surviving owners, bypassing probate.

- Tenancy by the Entirety: For married couples, this offers survivorship rights and exceptional protection from creditors against one spouse’s individual debts.

- Tenants in Common: Multiple people can own distinct shares without survivorship rights. Each owner can sell or will their portion independently.

Adverse Possession: The 7-Year Property Law

Florida’s adverse possession law allows someone to claim ownership of property they’ve occupied under very specific circumstances for at least seven consecutive years. The requirements are strict: the occupation must be continuous, open, hostile (without permission), and exclusive. Most importantly, the claimant must have paid all property taxes and filed returns on the property for the entire seven-year period. This law is critical for investors looking to Invest to understand during due diligence to ensure clear title.

Navigating 2024’s New Landscape: Critical Updates to Real Estate Law Florida

The landscape of real estate law Florida is always evolving, and 2024 brought significant changes focused on fraud prevention and transaction transparency. We stay on top of these developments by monitoring resources like MyFloridaHouse.gov to ensure our clients always have the most current information.

New Witness and Recording Requirements

To combat property fraud, Florida has implemented new safeguards:

- Witness Address Requirement: Effective January 1, 2024, witnesses on deeds and mortgages must provide their full post office address, making it easier to verify identities.

- Recording Notification Service: By July 1, 2024, every county must offer a free service that alerts you via email or text whenever a document is recorded using your name, helping to stop fraudulent transfers instantly.

- Lee County ID Pilot: A pilot program in Lee County requires government-issued ID verification to record a deed, a potential future standard for fraud prevention.

Changes to Commission Structures and the Role of Attorneys

The real estate industry saw a major shift in how agent commissions work. As noted in news reports, new laws are affecting Realtors, creating new options for buyers.

- Buyer-Broker Agreements: Buyers now typically sign explicit agreements with their agents detailing compensation, which could be a flat fee, hourly rate, or a negotiated percentage.

- Transparency and Savings: This change brings commission negotiations out in the open. It also creates opportunities for buyers to save money, as they can negotiate fees or hire an attorney for a fraction of the cost of a traditional commission, potentially saving thousands.

Standardized Deeds and Fraud Prevention

Florida has also tightened its rules on property deeds:

- Standardized Quitclaim Deeds: These deeds now follow a specific format to reduce errors and make them harder to manipulate fraudulently.

- New Quiet Title Actions: If your property is illegally transferred, you now have access to an expedited court process to reclaim your rightful ownership. Understanding these protections, part of our First Home Buyer Checklist, provides peace of mind.

The Professionals’ Playbook: Licensing, Representation, and Conduct

Behind every successful real estate transaction are professionals following a strict playbook governed by real estate law Florida. This includes licensing, representation, and ethical standards.

Obtaining and Maintaining a Florida Real Estate License

Becoming a licensed professional in Florida requires meeting high standards to protect consumers. The process includes:

- Completing 63 hours of pre-licensing education covering property law and real estate principles.

- Passing the comprehensive state real estate sales associate exam. More details can be found about the Florida Real Estate Sales Associate Exam.

- Undergoing a thorough background check.

- Submitting an application to the Department of Business and Professional Regulation (DBPR).

These standards ensure that all professionals, including our Mortgage Loan Officers, are qualified and trustworthy.

Understanding Brokerage Relationships in Florida

Florida law prohibits “dual agency.” Instead, licensees operate in one of two primary roles:

- Transaction Broker: Provides limited representation to both parties to facilitate the deal. They do not have a fiduciary duty but must act with honesty and skill.

- Single Agent: Provides full fiduciary representation to one party, owing them duties of loyalty, confidentiality, and obedience.

For large commercial deals, Designated Sales Associates from the same brokerage can represent different parties as single agents.

Rules of the Trade: Commissions, Offices, and Multiple Licenses

Key operational rules include a prohibition on paying referral fees to unlicensed individuals for real estate services. Only licensed brokers can open a real estate office, which must be properly registered. While brokers may hold multiple licenses, sales associates can only be registered with one broker at a time, ensuring clear supervision.

Why Understanding Florida Real Estate Law is Essential for Property Success

Florida’s real estate law is a complex web of statutes governing all property transactions. Whether you’re buying, selling, or investing, understanding these rules is key to protecting your interests and saving money.

Key Areas of Florida Real Estate Law:

- Primary Statutes: Chapter 475 (Real Estate Brokers), Florida RESPA, Title XL Property Laws

- Property Rights: Homestead protections, adverse possession, ownership types

- 2024 Updates: New witness requirements, commission structure changes, fraud prevention measures

- Professional Licensing: 63-hour education requirement, brokerage relationships, conduct rules

- Transaction Protection: Title research, escrow requirements, foreclosure procedures

Florida’s market has unique laws, from specific disclosure requirements to new fraud prevention measures effective in 2024. Transaction brokers are common, providing limited representation to both parties.

Recent changes, like new witness address requirements and evolving commission structures, make legal knowledge more critical than ever. These updates create opportunities but also require careful navigation.

I’m Joseph Cavaleri, Broker and CEO of Direct Express Realty. With over two decades of experience in thousands of transactions, my background as a broker and former loan officer provides unique insight into how real estate law Florida affects your property deals.

Foundations of Florida Real Estate Law: Key Statutes and Property Rights

Welcome to the heart of real estate law Florida! Navigating the vibrant real estate markets of St. Petersburg, Tampa Bay, or Parrish requires a solid grasp of these foundational principles.

The Florida Statutes, particularly Title XL (“Real and Personal Property”), form the backbone of our legal system. Within this, Chapter 475 governs “Real Estate Brokers, Sales Associates, Schools, and Appraisers,” defining the rules for all professionals to ensure fair play and protect consumers. Understanding these laws is paramount when Buying a Home or selling an investment property.

Understanding Florida’s Core Real Estate Statutes

The primary statutes governing real estate law Florida are Chapters 475, 455, 215, 120, and 20. For consumers, the Florida Real Estate Settlement Procedures Act (RESPA) is critical. It ensures transparency by requiring detailed closing cost information and prohibiting unfair practices like kickbacks. This protects you from surprises at the closing table. For a deeper dive, you can explore The 2024 Florida Statutes.

Your Rights as a Property Owner in Florida

Owning property in Florida comes with a bundle of rights, including the right to use, maintain, develop, and exclude others. The form of ownership also matters:

- Joint Tenancy: Co-owners have equal shares and a “right of survivorship,” meaning a deceased owner’s share automatically passes to the surviving owners, avoiding probate.

- Tenancy by the Entirety: Exclusive to married couples, this offers survivorship rights and protects the property from one spouse’s individual creditors.

- Tenants in Common: Co-owners have distinct interests with no right of survivorship; their share passes to their heirs.

Adverse Possession: The 7-Year Property Law

Adverse possession, the “7-year property law,” allows someone to claim ownership of property they’ve occupied for at least seven years. The criteria are very strict: occupation must be continuous, open, hostile, and exclusive. Crucially, the claimant must have paid all property taxes during the seven-year period. This law is designed to resolve long-standing disputes and is an important consideration when you Invest in property.

Navigating 2024’s New Landscape: Critical Updates to Real Estate Law Florida

The world of real estate law Florida is dynamic, and 2024 brought significant updates aimed at enhancing transparency and combating property fraud. We monitor legislative developments through resources like MyFloridaHouse.gov to keep our clients ahead of the curve.

New Witness and Recording Requirements

Key changes in 2024 add layers of security to property transactions:

- Witness Address Requirement: As of January 1, 2024, witnesses on deeds must provide their addresses, making it easier to verify their identity.

- Recording Notification Service: By July 1, 2024, counties must offer a free service to alert property owners when a document is recorded in their name, helping to prevent fraud.

- Lee County Identity Verification Pilot: This program, running until late 2025, requires government-issued ID for anyone recording a deed, an innovative step against title fraud.

Changes to Commission Structures and the Role of Attorneys

Recent legal settlements have changed how real estate commissions are structured. As many in Real Estate have heard about the new laws affecting Realtors, sellers are no longer required to offer commission to buyer’s agents. This shift leads to:

- Buyer-Broker Agreements: Buyers will now enter into explicit agreements with their agents to determine compensation.

- Greater Transparency and Options: This change provides buyers with clearer information and the option to hire an attorney for a flat fee instead of a traditional agent, potentially saving thousands of dollars on a purchase.

Standardized Deeds and Fraud Prevention

To further combat fraud, real estate law Florida has introduced new measures:

- New Standardized Quitclaim Deeds: Florida has standardized the form for quitclaim deeds to reduce errors and prevent manipulation.

- Quiet Title Actions: A new, expedited court process is available to help property owners reclaim their title if it has been fraudulently conveyed.

Understanding these protections is a crucial part of your First Home Buyer Checklist.

The Professionals’ Playbook: Licensing, Representation, and Conduct

Behind every successful real estate transaction in Florida are dedicated professionals adhering to a strict “playbook.” This section covers licensing, representation, and the ethical conduct expected in real estate law Florida.

Obtaining and Maintaining a Florida Real Estate License

Becoming a licensed real estate professional in Florida is a structured process designed to ensure competence and integrity.

- Requirements: An applicant must be at least 18, hold a high school diploma or equivalent, and be of good character.

- Licensing Process: This involves 63 hours of pre-licensing education, passing the Florida Real Estate Sales Associate Exam, a background check, and applying with the Department of Business and Professional Regulation (DBPR).

- Name Changes: Licensees must notify the DBPR of any name change to keep records accurate.

These high standards also apply to our Mortgage Loan Officers.

Understanding Brokerage Relationships in Florida

One of the most important concepts in real estate law Florida is understanding brokerage relationships. Florida prohibits “dual agency,” where one agent represents both parties with full fiduciary duty. Instead, licensees operate as either a Transaction Broker or a Single Agent.

A Transaction Broker provides limited, non-fiduciary representation to facilitate a deal for both parties. Their duties include dealing honestly, accounting for funds, using skill and care, and disclosing known property facts.

A Single Agent provides full fiduciary representation to one party. This includes all the duties of a transaction broker, plus the duties of confidentiality, loyalty, obedience, and full disclosure. They advocate solely for their client’s best interests.

Rules of the Trade: Commissions, Offices, and Multiple Licenses

Florida law is strict on compensation: referral fees cannot be paid to unlicensed individuals for real estate services, with a minor exception for tenant referrals in property management (up to $50). Only a licensed broker can open a real estate office, which must be properly registered and identified. Brokers can hold multiple licenses, but sales associates are limited to one license under one supervising broker.

Protecting Your Title and Investment in Florida

When dealing with property, your title and investment are paramount. In real estate law Florida, robust protections ensure your peace of mind. Our integrated services at Direct Express are designed to cover all bases, from securing your Mortgage to safeguarding your property’s title.

Title, Deeds, and Closing Procedures

The closing process transfers ownership. Key components include:

- Title Search & Insurance: A title search examines a property’s history for claims or liens. Title insurance is a one-time purchase at closing that protects you from future title disputes.

- Deeds: A warranty deed offers the most protection, guaranteeing the seller has clear title. A quitclaim deed offers no guarantees, simply transferring whatever interest the seller has. A Lady Bird Deed is an estate planning tool that allows property to pass to a beneficiary upon death, avoiding probate.

- Escrow: Earnest money is held in a neutral escrow account until all contract conditions are met.

Understanding Mortgages and Foreclosure in Florida real estate law

Most property purchases involve a Mortgage. It’s vital to read your loan agreement carefully. Florida is a judicial foreclosure state, meaning a lender must go through the court system to foreclose on a property. This process provides homeowners more time to seek alternatives compared to non-judicial states.

Special Considerations for Investors and Foreign Sellers

- 1031 Exchanges: Investors can defer capital gains taxes by selling one investment property and reinvesting the proceeds into another within strict timeframes (45 days to identify, 180 days to close).

- Vacation Rentals: Local ordinances and HOA rules heavily regulate short-term rentals. Always research these before buying an investment property. Our Beginners Guide to Property Management offers more insight.

- LLCs: Holding properties in a Limited Liability Company (LLC) can protect your personal assets from business-related lawsuits.

- FIRPTA: The Foreign Investment in Real Property Tax Act (FIRPTA) requires buyers to withhold 15% of the sales price from foreign sellers to cover potential U.S. capital gains taxes.

Frequently Asked Questions about Florida Real Estate Law

Navigating property in the Sunshine State can be complex. Here are answers to the most common questions about real estate law Florida.

What is the main law that governs real estate in Florida?

The primary law is Florida Statutes Chapter 475. It governs the licensing and conduct of real estate brokers and sales associates. For consumer protection during the transaction itself, the Florida Real Estate Settlement Procedures Act (RESPA) is also key, as it mandates transparency in closing costs and prohibits kickbacks.

What are my property rights as a homeowner in Florida?

As a homeowner, you have a “bundle of rights,” including the rights of possession, control, enjoyment, and disposition (to sell, lease, or get a Mortgage). Florida also offers powerful homestead protections, which include significant property tax exemptions and, most importantly, protection of your primary residence from forced sale by most creditors.

Does Florida require an attorney for a real estate closing?

No, Florida law does not require an attorney for a residential closing; title companies and real estate agents can handle the process. However, it is highly advisable. An attorney provides crucial legal advice, reviews complex contracts, resolves title issues, and represents your interests in any disputes. For a major financial transaction, legal counsel is a smart investment.

Conclusion

We’ve journeyed through the essentials of real estate law Florida, from foundational statutes to the crucial 2024 updates. Staying informed about witness requirements, commission changes, and professional representation is key to a successful transaction. Whether you’re working with a transaction broker or a single agent, understanding their role is vital.

Due diligence is your most powerful tool. Thorough research into titles, contracts, and local regulations will protect your interests, whether you’re looking to Invest, securing your first Mortgage, or learning from our Beginners Guide to Property Management. While an attorney isn’t required for closing, their guidance is invaluable for navigating complex issues.

At Direct Express, we simplify this process by offering integrated services under one roof—from realty and mortgages to property management and construction. This comprehensive approach means you have one experienced team guiding you.

Ready to turn your property goals into reality? Visit our Realty Sell page to see how we can help you succeed in the Florida market.