Why Understanding Property Management Pricing Matters for Your Investment Success

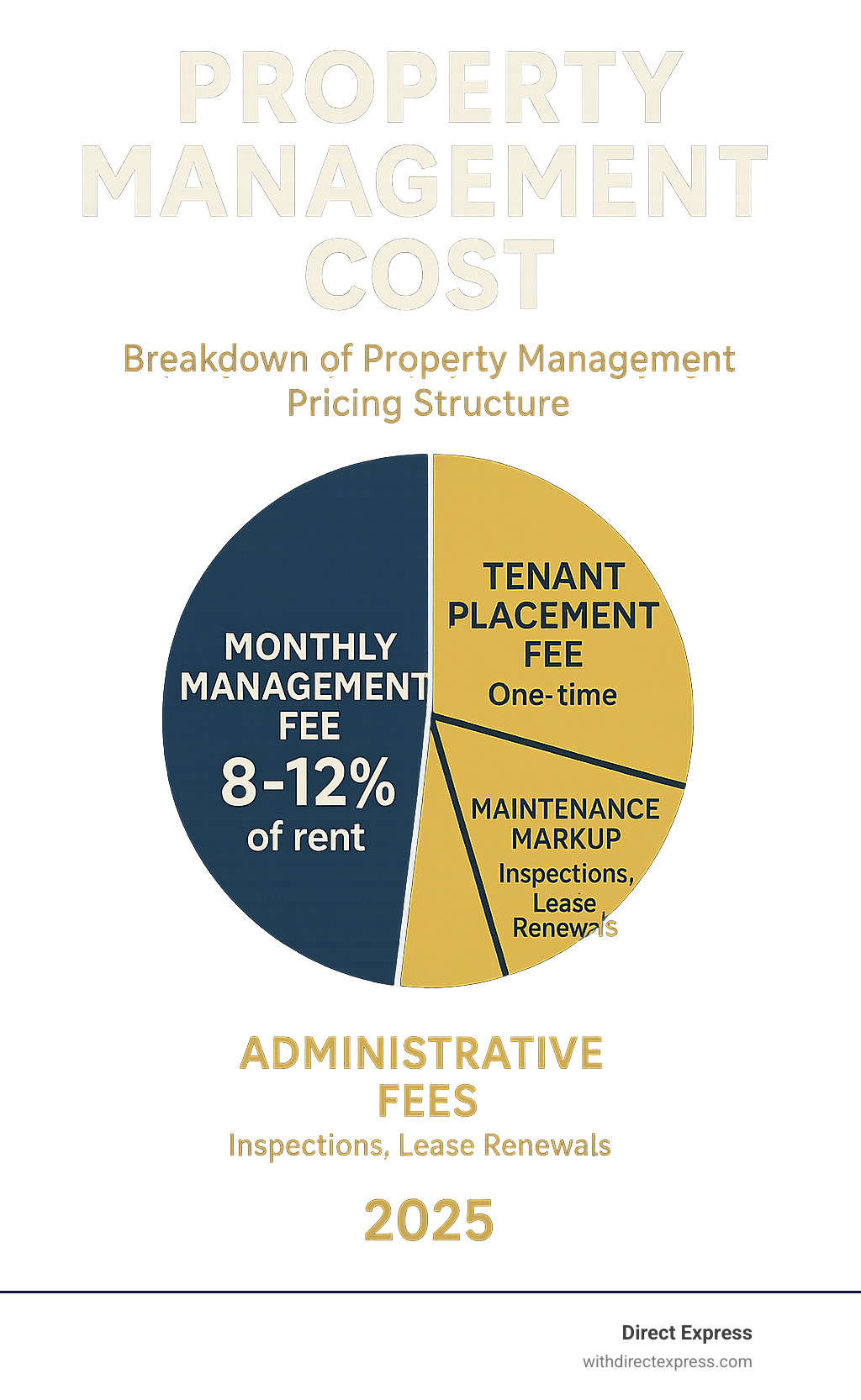

Property management cost typically ranges from 8% to 12% of monthly rental income, with additional fees for services like tenant placement, maintenance coordination, and lease renewals.

Quick Answer: What You’ll Pay for Property Management

- Monthly Management Fee: 8-12% of collected rent

- Tenant Placement Fee: 50-100% of first month’s rent

- Setup/Onboarding Fee: $250-$500 (one-time)

- Maintenance Markup: 10-20% on repair costs

- Lease Renewal Fee: $150-$300

- Inspection Fees: $50-$200 per visit

As one property owner shared in our research: “I was missing my son’s big game to fix a leaking toilet” – a perfect example of why many investors choose professional management despite the costs.

Understanding these fees upfront prevents financial surprises and helps you decide if professional management fits your investment strategy.

Truthfully, property management cost is an investment in your peace of mind and your property’s performance, provided you choose the right partner and understand the value.

I’m Joseph Cavaleri, CEO of Direct Express Rentals with over two decades of experience in property management and real estate. Throughout my career, I’ve helped countless investors steer property management cost decisions and build profitable rental portfolios.

Quick look at property management cost:

Unpacking the Core Management Fees

When exploring property management cost, the monthly management fee is your starting point. However, not all management fees are structured the same way.

You’re essentially hiring a CEO for your rental property, and their compensation can be based on performance or a flat rate.

Most property managers use one of two approaches: percentage-based fees that tie their success to yours, or flat fees that give you predictable monthly costs. Industry standards typically fall between 8% and 12% of your monthly rental income, but the structure you choose can make a big difference in how motivated your manager stays.

Percentage-Based Fees

With percentage-based pricing, your property manager takes a slice of whatever rent they actually collect. If your property rents for $2,000 and they charge 10%, they earn $200 that month. No rent collected? No fee paid.

This aligns incentives: your manager only makes money when you make money. They’re motivated to find great tenants quickly, keep them happy, and chase down late payments, acting as a partner in your success.

The typical range sits between 8% to 12% of collected rent. Notice I said collected – that’s crucial. A good contract specifies you only pay on money that actually hits your bank account, not on rent that’s theoretically due but never arrives.

One property owner told me, “My manager worked harder to collect a late payment than I ever would have, because they knew their paycheck depended on it too.” That’s the percentage model working exactly as it should.

If you’re new to this world, our Beginner’s Guide to Property Management walks you through these decisions step by step.

Flat-Fee Structures

Sometimes predictability wins over performance incentives. With flat fees, you pay the same amount every month – typically between $100 to $200 – regardless of your rental income or vacancy periods.

This approach shines for lower-rent properties. If your property rents for $800, a 10% fee would only be $80. But that might not provide enough incentive for quality management. A $150 flat fee ensures your manager can afford to give your property proper attention.

Flat fees also make budgeting incredibly simple. You know your exact property management cost each month, with no surprises.

The trade-off? Your manager gets paid the same whether your property sits vacant for weeks or stays occupied all year. They earn the same $150 whether they rent it for $800 or negotiate $900. It removes some of that performance pressure that makes percentage fees so effective.

For many investors, especially those with multiple lower-value properties, this predictable structure provides the budgeting ease they need to sleep well at night.

Beyond the Monthly Rate: Common Additional Charges

The advertised monthly fee is just the start of your total property management cost. It’s important to understand the full price before you commit.

Most property management companies charge additional fees for specific services that go beyond basic day-to-day operations. These might include leasing fees for finding new tenants, maintenance costs with markups, administrative charges for various services, eviction fees if legal action becomes necessary, and sometimes even vacancy fees. The key is understanding these upfront so you can budget accurately.

The monthly fee covers routine operations, but events like tenant turnover, burst pipes, or legal intervention often have separate charges.

Tenant Placement and Leasing Fees

Finding the right tenant is one of the most valuable services a property manager provides. The process is far more involved than most people realize.

The tenant placement fee typically covers the entire journey from empty property to signed lease. This includes marketing your property with professional photography, coordinating showings, performing comprehensive tenant screening with background checks, and preparing all lease documentation to ensure legal compliance.

A professional manager’s systematic approach to tenant screening is invaluable, as it can save you from costly mistakes that many DIY landlords make.

The cost for this service typically ranges from 50% to 100% of the first month’s rent. So if your property rents for $1,500, you might pay between $750 and $1,500 for tenant placement. Some companies charge a flat rate instead, usually between $300 and $500. While this might seem steep, a bad tenant can easily cost you thousands in damages, lost rent, and legal fees.

Maintenance, Repairs, and Inspections

Story about the property owner missing his son’s game to fix a toilet? This is where professional property management really shines – handling those inevitable maintenance issues so you don’t have to.

Most property managers handle maintenance coordination by adding a markup to contractor invoices, typically 10% to 20% of the repair cost. This markup gives you access to a network of trusted contractors, faster response times, quality oversight, and frees you from the headache of coordinating repairs.

Emergency repairs are handled promptly, often with 24/7 availability. Routine inspections cost between $50 to $200 per visit but can catch small problems before they become expensive disasters.

Many property managers require a small reserve fund – typically $100 to $300 – held in trust for minor repairs. This allows them to fix small issues immediately without calling you for approval on every $50 repair. It keeps tenants happy and prevents minor problems from escalating.

For more guidance on managing these funds effectively, check out this helpful information on setting up a reserve fund. At Direct Express, our integrated approach to Property Management and Maintenance often means faster response times and better pricing, since we can use our own skilled teams rather than always relying on outside contractors.

A Checklist for Understanding Your Full Property Management Cost

Beyond the main monthly and leasing fees, several other charges can pop up. Being aware of these helps you budget accurately and choose the right management company.

Onboarding or setup fees typically range from $250 to $500 as a one-time charge. Lease renewal fees of $150 to $300 cover the paperwork and negotiations for lease extensions. Eviction processing fees can range from $300 to over $1,000, not including court costs.

Some companies charge early termination fees if you end your contract early, bill payment fees of $20 to $30 monthly for handling property-related expenses, and small technology fees of $10 to $20 for access to online portals.

Vacancy fees might apply when your property sits empty – either a flat monthly rate or percentage of one month’s rent. While this might seem counterintuitive, it incentivizes quick tenant placement since vacant properties cost owners about $40 per day in lost income.

Understanding these potential costs upfront ensures you have a realistic picture of your total property management cost.

What Factors Influence the Total Property Management Cost?

Property management cost changes based on your property’s unique characteristics, such as its type, size, condition, location, and the services required.

For example, managing a single-family home in Lutz requires different skills and time than overseeing an apartment complex in downtown Tampa, and the cost reflects that.

The good news? Understanding these factors helps you budget accurately and choose the right management partner for your specific investment goals.

How Property Type and Size Affect Fees

Your property type is like your property’s personality – and different personalities need different approaches to management.

Single-family homes typically see higher percentage fees, around 10-12% of monthly rent. With all energy focused on one tenant and lease, you get dedicated attention, which is reflected in the fee.

Multi-family properties are where economies of scale kick in. Managing a duplex, triplex, or apartment building is more efficient. Instead of driving across town, your manager can address multiple units in one location. This efficiency typically translates to lower per-unit fees, often ranging from 6% to 10%.

Commercial properties dance to their own rhythm. Office buildings and retail spaces involve specialized tenant relationships and longer lease terms. The property management cost for commercial properties typically ranges from 4% to 12%, sometimes with additional flat-fee components.

Short-term rentals are the high-maintenance cousins of the rental world. They demand significantly more attention due to constant guest turnover, extensive cleaning coordination, and 24/7 guest communication. Management fees for short-term rentals often range from 15% to 40% of nightly rates, reflecting a much broader scope of services.

The more units you have, the better your per-unit pricing typically becomes.

The Impact of Location and Market Dynamics

Location isn’t just important for property values – it’s a major player in determining your property management cost too.

Urban properties in competitive markets like Tampa or St. Petersburg often benefit from more competitive pricing. With numerous property management companies vying for business, you’re likely to find better rates and more service options.

Rural properties or those in smaller markets might face higher fees simply because there are fewer management companies to choose from. Less competition often means higher prices.

Market competition in your area directly affects your options and pricing. In busy markets, you’ll find more competitive rates. Smaller markets might have limited options, but the companies operating there often have deep local expertise that’s incredibly valuable.

Regional regulations add another layer. Florida’s specific landlord-tenant laws and local housing ordinances can be complex. Cities like Tampa and St. Petersburg each have unique requirements that property managers must follow. A manager’s expertise in local legal compliance isn’t just valuable – it’s essential for protecting your investment.

Your property’s location story – whether it’s a beachfront condo, suburban family home, or urban apartment building – directly shapes the challenges and expertise required.

Is a Property Manager Worth It?

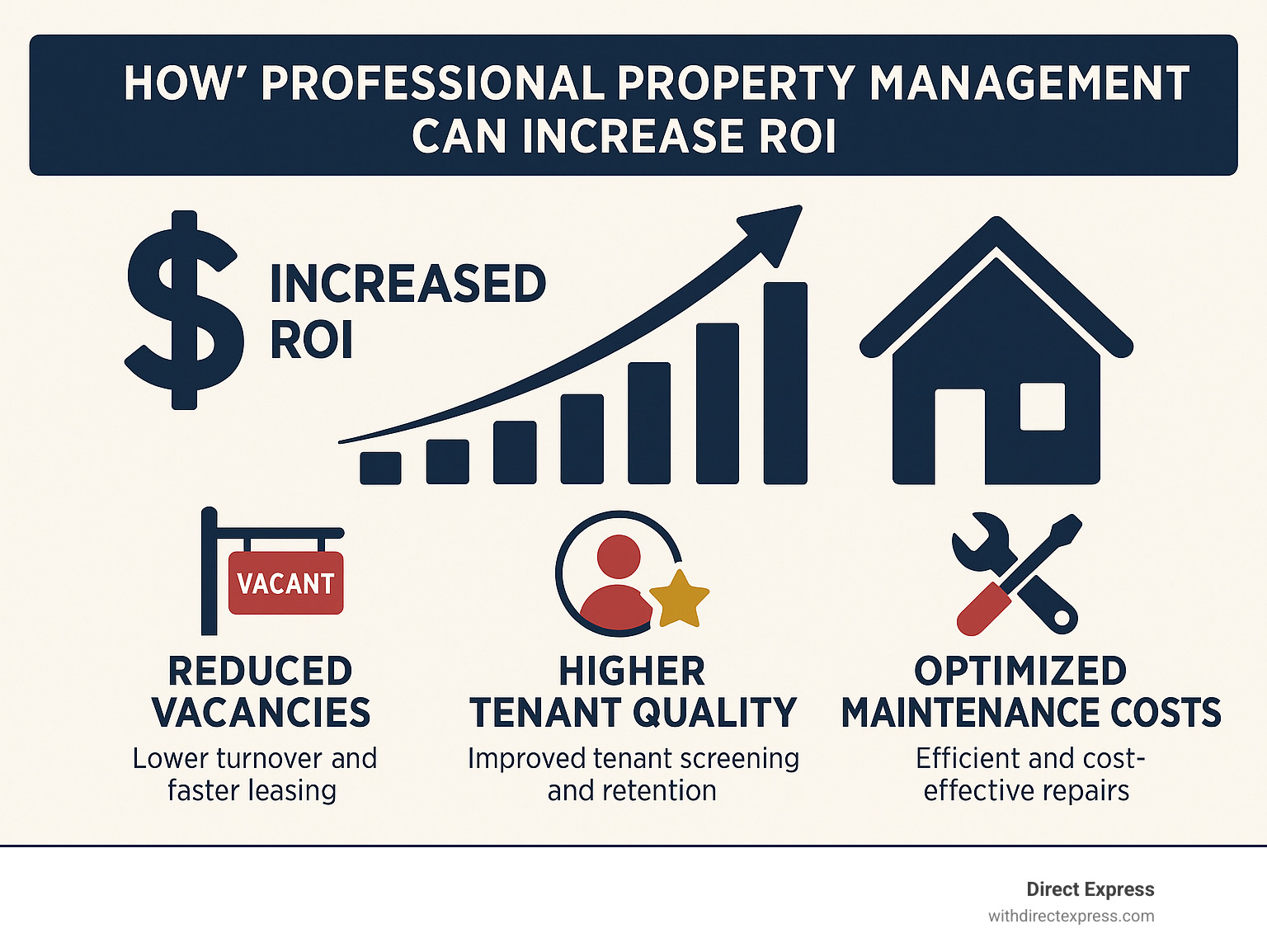

When looking at property management cost, it’s natural to question the value. However, successful investors view these fees as a strategic investment that increases long-term profit.

When you hire a property manager, you’re buying freedom from emergency calls, peace of mind about legal compliance, and expertise in tenant screening. As one frustrated DIY landlord told us, “I realized I was paying for my lack of expertise with my time, my stress levels, and ultimately, my profits.”

The value proposition goes far beyond just collecting rent. Professional property managers bring expertise in market pricing, legal knowledge, and systems that turn chaotic rental ownership into a smooth, profitable operation. When you factor in the time you save and the headaches you avoid, many investors find the property management cost pays for itself.

Analyzing the ROI of Your Property Management Cost

Let’s talk numbers. While you pay a monthly fee, a skilled property manager often works behind the scenes to increase your net income by more than they charge.

Reduced vacancy rates alone can justify the entire management fee. A vacant property bleeds about $40 per day in lost income. Professional managers have the marketing expertise and tenant networks to fill vacancies faster than most DIY landlords.

Higher-quality tenants represent another massive return on investment. Through rigorous screening, property managers place tenants who pay on time, stay longer, and treat your property with respect. One bad tenant can cost thousands in damages and lost rent – far more than years of management fees.

Preventative maintenance savings add up quickly. Routine inspections catch small problems before they become expensive disasters. A $50 inspection fee that prevents a $5,000 flood damage claim is a profitable trade-off.

Property managers also optimize your rental income through market knowledge. Some studies suggest professional management can increase rental income by up to 20% compared to amateur landlords who guess at market rates.

Don’t forget the tax benefits. Most property management cost expenses are tax-deductible business expenses for your rental property. This can significantly reduce your taxable income, making the effective cost of professional management much lower. For specific guidance, check out information on tax-deductible expenses.

When you crunch these numbers, professional management often pays for itself while giving you back your time. If you’re ready to expand your portfolio with this support, our Invest services can help you grow strategically.

The Benefits of Integrated Real Estate Services

Direct Express takes property management to the next level by offering integrated real estate services. Imagine one trusted partner handling everything from finding your next investment property to fixing a leaky pipe. That’s the power of an integrated approach.

Streamlined management means you make one call to people who already know you, your properties, and your investment goals. This isn’t just convenient – it’s strategically smart.

One point of contact eliminates the communication breakdowns that can plague real estate investing. Your property manager, mortgage specialist, and construction team are all part of the same company.

Our in-house maintenance and construction teams mean faster response times. When a pipe bursts in your Tampa Bay rental at 2 AM, our plumbing team can respond immediately because they’re part of our integrated system.

Simplified transactions become a reality when you’re ready to buy, sell, or refinance. We can handle the entire process seamlessly, from listing and marketing to finding your next investment and securing financing. Our Buying a Home services integrate perfectly with our property management division.

This integrated approach transforms a complicated web of relationships into a simple, efficient system designed around your success.

Frequently Asked Questions about Property Management Fees

Here are answers to common questions investors have about property management cost.

What is the difference between a monthly management fee and a tenant placement fee?

Think of it this way: the monthly management fee is for ongoing oversight, while the tenant placement fee is a one-time charge for a specific procedure.

Your monthly management fee covers day-to-day operations like rent collection, maintenance coordination, tenant communication, and financial reporting. It’s the recurring cost that ensures someone is always watching over your investment.

The tenant placement fee is a one-time charge that kicks in when we need to find you a new tenant. This covers the intensive work of marketing, showings, comprehensive background checks, and preparing all the lease paperwork. It’s a lot of work packed into a short timeframe, which is why it’s charged separately.

Are property management fees negotiable?

Absolutely! Property management cost isn’t set in stone, especially if you own multiple properties or you’re in a competitive market like Tampa Bay. You have some bargaining power.

Property owners with several units can often negotiate lower percentage rates or more favorable terms. The key is understanding what you’re asking for. A company might reduce their monthly fee but maintain other charges, or bundle services differently to give you better overall value.

However, the cheapest option isn’t always the smartest choice. Chasing the lowest fee can lead to poor service and costly problems. Paying for quality management can save you thousands in the long run by avoiding problem tenants and major maintenance issues.

Are property management fees tax deductible?

Yes, this is music to most property owners’ ears! In the vast majority of cases, your property management cost is considered a legitimate business expense for your rental property, which means it’s tax deductible.

The IRS generally views property management fees as ordinary and necessary expenses for operating your rental business. This can make a real difference in your bottom line because it reduces your taxable rental income. So if you’re paying $200 a month in management fees, that’s $2,400 a year you can typically deduct.

However, tax laws can be tricky. I always recommend chatting with a qualified tax professional who can give you personalized advice for your specific circumstances.

The bottom line? Understanding these fees upfront helps you make informed decisions, and knowing they’re typically deductible makes the investment in professional management even more attractive.

Conclusion

Understanding property management cost is about making smart choices for your real estate investment. Throughout this guide, we’ve covered core monthly fees (whether percentage-based or flat) and the additional charges that can arise, like tenant placement fees, maintenance markups, and inspection costs.

We’ve also seen how your specific situation matters. The type of property you own, its size, and its location all play a role in what you’ll pay. A beachfront condo in St. Petersburg will have different management needs than a single-family home in Lutz, and the costs reflect that.

While professional management has a property management cost, the value often far outweighs the expense. A skilled property manager saves you time, reduces stress, secures quality tenants, ensures legal compliance, and can boost your bottom line in ways you might not realize.

It’s an investment in your sanity and your property’s long-term success, not just another expense eating into your profits.

At Direct Express, we’ve built our entire approach around being completely transparent about pricing and delivering comprehensive service. Our integrated model means you’re not juggling different companies for different needs. Whether you need help buying your next investment property, securing financing, managing what you already own, or handling construction and repairs, we have everything under one roof right here in Florida.

We serve clients from Palm Harbor all the way down to Parrish, and we’re committed to making sure there are never any surprise fees or hidden costs. We believe you deserve to know exactly what you’re paying for and why it’s worth every penny.

Ready to stop worrying about the complexities of rental property ownership and start enjoying the benefits? Learn more about our comprehensive Property Management services and find how we can help you achieve truly effortless rental ownership. Your future self will thank you.